"With world leaders meet at the end of this week at the G-20 summit in Cannes, France, the next economic minefield that they will face is already coming into view. It is likely to take the form of an opaque global credit glut, turbocharged by the fragile mixture of too-big-to-fail global banking with a huge and largely unwatched and unregulated shadow banking sector.

To be sure, that is not what many see. Federal Reserve Board Chairman Ben Bernanke and others have blamed the financial crisis of 2008 on a global savings glut, which fuelled flows of money from high-savings emerging-market economies – especially in Asia – that run chronic balance-of-payments surpluses. According to this school of thought, excessive savings pushed long-term interest rates down to rock-bottom levels, leading to asset bubbles in the United States and elsewhere.

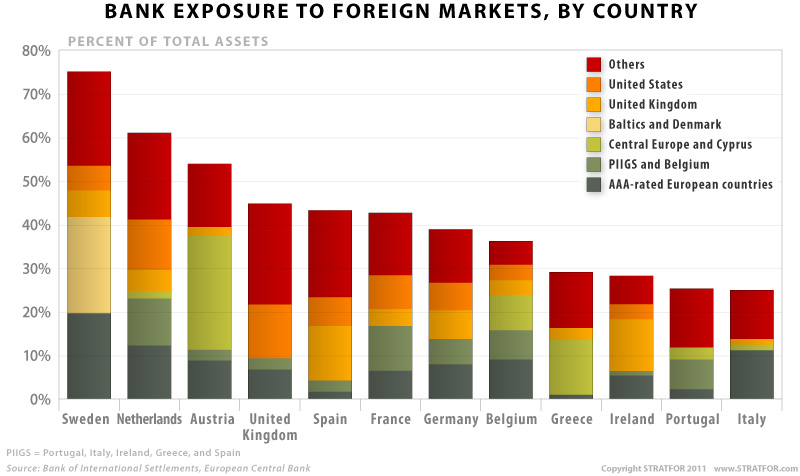

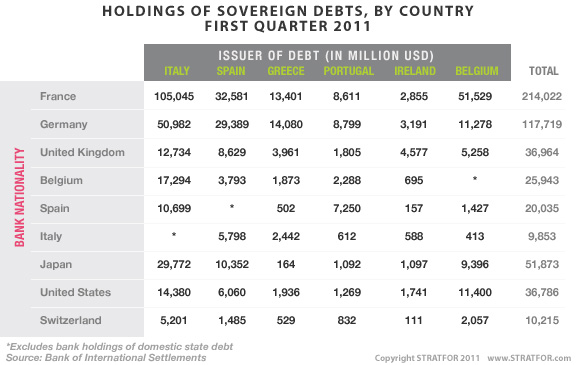

But Claudio Borio and Piti Disayat, economists at the Bank for International Settlements, have argued convincingly that the savings-glut theory fails to explain the unsustainable credit creation in the run-up to the 2008 crisis. They have shown that the major capital inflows were not from emerging markets, but from Europe, where there was no net balance-of-payments surplus.

The alternative theory – of a global credit glut – gained more ground with the release last week of the Financial Stability Board’s report on shadow banking. The FSB report contains startling revelations about the scale of global shadow banking, which it defines as “credit intermediation involving entities and activities outside the regular banking system.”

The report, which was requested by G-20 leaders at their summit in Seoul last November, found that between 2002 and 2007, the shadow banking system increased by $33 trillion, more than doubling in asset size from $7 trillion to $60 trillion. This is 8.5 times higher than the total US current-account deficit of $3.9 trillion during the same period.

The shadow banking system is estimated at roughly 25-30% of the global financial system ($250 trillion, excluding derivatives) and at half of total global banking assets. This represents a huge regulatory “black hole” at the center of the global financial system, hitherto not closely monitored for monetary and financial stability purposes. Its importance was exposed only by analysis of the key roles played by structured investment vehicles (SIVs) and money-market funds (MMFs) in the 2008 meltdown.

The shadow banking system is complex, because it comprises a mix of institutions and vehicles. Investment funds other than MMFs account for 29% of total, and SIVs make up 9%, but the shadow system also includes public financial institutions (such as the government-backed mortgage lender Fannie Mae in the US). They are some of the largest counterparties with the regular banking system, and their combined credit creation and proprietary trading and hedging may account for much of the global liquidity flows that make monetary and financial stability so difficult to ensure.

The trouble is that, by 2010, the shadow banking system was about the same size as it was just before the 2007 market crash, whereas the regulated global banking system was 18% larger than in 2007. That is why the FSB report pinpoints the shadow banking system, together with the large global banks, as sources of systemic risk. But the global problem is likely to be much larger than the sum of its parts. Specifically, global credit creation by the regular and shadow banking systems is likely to be significantly larger than the sum of the credit creation currently measured by national statistics.

There are several reasons for this. First, credit that can be, and is, created offshore and through off-balance-sheet SIVs is not captured by national balance-of-payments statistics. In other words, while a “savings” glut may contribute to low interest rates and fuel excess credit creation, it is not the main cause.

Second, the volatile “carry trade” is notoriously difficult to measure, because most of it is conducted through derivatives in options, forwards, and swaps, which are treated as off-balance sheet – that is, as net numbers that are below the line in accounting terms. Thus, in gross terms, the leverage effects are larger than currently reported.

Third, the interaction between the shadow banking system and the global banks is highly concentrated, because the global banks act as prime brokers, particularly for derivative trades. Data from the US Comptroller of Currency suggest that the top five US banks account for 96% of the total over-the-counter (OTC) derivative trades in the US.

Indeed, the nightmare scenario haunting the world is the collapse of another shadow banking entity, causing global trade to freeze, as happened in 2008. The Basel III agreement on capital adequacy and other recent reforms still have not ring-fenced trade financing from these potential shocks.

We urgently need to monitor and understand the role of shadow banking and the too-big-to-fail banks in creating the global credit glut. Obtaining a full picture of global monetary and credit numbers and their determinants is a vital first step.

So far, the G-20’s call to “think globally” has turned into “act locally.” We hope that the G-20 leaders will think systemically at Cannes, and act nationally and cooperatively to defuse the global credit glut minefield."

at http://www.project-syndicate.org/commentary/sheng1/English

To be sure, that is not what many see. Federal Reserve Board Chairman Ben Bernanke and others have blamed the financial crisis of 2008 on a global savings glut, which fuelled flows of money from high-savings emerging-market economies – especially in Asia – that run chronic balance-of-payments surpluses. According to this school of thought, excessive savings pushed long-term interest rates down to rock-bottom levels, leading to asset bubbles in the United States and elsewhere.

But Claudio Borio and Piti Disayat, economists at the Bank for International Settlements, have argued convincingly that the savings-glut theory fails to explain the unsustainable credit creation in the run-up to the 2008 crisis. They have shown that the major capital inflows were not from emerging markets, but from Europe, where there was no net balance-of-payments surplus.

The alternative theory – of a global credit glut – gained more ground with the release last week of the Financial Stability Board’s report on shadow banking. The FSB report contains startling revelations about the scale of global shadow banking, which it defines as “credit intermediation involving entities and activities outside the regular banking system.”

The report, which was requested by G-20 leaders at their summit in Seoul last November, found that between 2002 and 2007, the shadow banking system increased by $33 trillion, more than doubling in asset size from $7 trillion to $60 trillion. This is 8.5 times higher than the total US current-account deficit of $3.9 trillion during the same period.

The shadow banking system is estimated at roughly 25-30% of the global financial system ($250 trillion, excluding derivatives) and at half of total global banking assets. This represents a huge regulatory “black hole” at the center of the global financial system, hitherto not closely monitored for monetary and financial stability purposes. Its importance was exposed only by analysis of the key roles played by structured investment vehicles (SIVs) and money-market funds (MMFs) in the 2008 meltdown.

The shadow banking system is complex, because it comprises a mix of institutions and vehicles. Investment funds other than MMFs account for 29% of total, and SIVs make up 9%, but the shadow system also includes public financial institutions (such as the government-backed mortgage lender Fannie Mae in the US). They are some of the largest counterparties with the regular banking system, and their combined credit creation and proprietary trading and hedging may account for much of the global liquidity flows that make monetary and financial stability so difficult to ensure.

The trouble is that, by 2010, the shadow banking system was about the same size as it was just before the 2007 market crash, whereas the regulated global banking system was 18% larger than in 2007. That is why the FSB report pinpoints the shadow banking system, together with the large global banks, as sources of systemic risk. But the global problem is likely to be much larger than the sum of its parts. Specifically, global credit creation by the regular and shadow banking systems is likely to be significantly larger than the sum of the credit creation currently measured by national statistics.

There are several reasons for this. First, credit that can be, and is, created offshore and through off-balance-sheet SIVs is not captured by national balance-of-payments statistics. In other words, while a “savings” glut may contribute to low interest rates and fuel excess credit creation, it is not the main cause.

Second, the volatile “carry trade” is notoriously difficult to measure, because most of it is conducted through derivatives in options, forwards, and swaps, which are treated as off-balance sheet – that is, as net numbers that are below the line in accounting terms. Thus, in gross terms, the leverage effects are larger than currently reported.

Third, the interaction between the shadow banking system and the global banks is highly concentrated, because the global banks act as prime brokers, particularly for derivative trades. Data from the US Comptroller of Currency suggest that the top five US banks account for 96% of the total over-the-counter (OTC) derivative trades in the US.

Indeed, the nightmare scenario haunting the world is the collapse of another shadow banking entity, causing global trade to freeze, as happened in 2008. The Basel III agreement on capital adequacy and other recent reforms still have not ring-fenced trade financing from these potential shocks.

We urgently need to monitor and understand the role of shadow banking and the too-big-to-fail banks in creating the global credit glut. Obtaining a full picture of global monetary and credit numbers and their determinants is a vital first step.

So far, the G-20’s call to “think globally” has turned into “act locally.” We hope that the G-20 leaders will think systemically at Cannes, and act nationally and cooperatively to defuse the global credit glut minefield."

at http://www.project-syndicate.org/commentary/sheng1/English