"Under Fed Chairman Ben Bernanke, the Fed has been the great enabler of Washington’s fiscal excesses of the past few years. The Fed’s quantitative easing blurs the line between fiscal and monetary policies. The Fed may still be politically independent, but fiscal policy has become very dependent on the willingness of the Fed to purchase lots of government securities. A consolidated statement of the US Treasury and the Fed would show that $1.7 trillion of US government debt, which is held at the Fed, is costing the government only 0.25%.

In yesterday’s WSJ, Jon Hilsenrath reported that the FOMC is likely to vote for QE4 when the committee meets on December 11-12. In September, the FOMC implemented QE3, i.e., an open-ended commitment to purchase mortgage-backed securities at the rate of $40 billion per month. The Fed’s Operation Twist is scheduled to terminate at the end of the year. Under this program, the Fed purchased $45 billion a month in long-term Treasuries, paying for them with the proceeds from its holdings of short-term debt.

Now some members of the FOMC are pushing for more purchases of Treasury bonds. However, the Fed is running out of short-term securities to sell. Hence, QE4! As Hilsenrath observes:

“The Fed has run down its stockpile of the short-term Treasurys to sell to fund long-term purchases. To keep buying the long-term bonds it would need to fund the purchases by creating new bank reserves, which in effect is printing money. That is how the Fed has funded previous Treasury purchase programs and how it is funding the mortgage-bond buying. Though critics say this could be especially inflationary, many Fed officials believe they can manage the reserves without risking inflation.”

at http://blog.yardeni.com/2012/11/us-monetary-fiscal-policies.html#ixzz2DdnjICGO

Links to global economy, financial markets and international politics analyses

Thursday, November 29, 2012

Jim Rogers: We Will have Wars

"Daily Bell: Are there going to be additional wars?

Jim Rogers: Oh, yeah. Throughout history there has always been war. There is no period in history where we didn't have wars of some sort. Politicians like to blame somebody and it's easier to blame foreigners, so as tensions rise people will blame foreigners more and more.

Also, I'm told throughout history when you have shortages of raw materials, that leads to strife and wars and we have shortages of raw materials developing which will be bigger and bigger. So we will have wars. - in Daily Bell"

at http://jimrogers1.blogspot.com/2012/11/jim-rogers-we-will-have-wars.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Jim Rogers: Oh, yeah. Throughout history there has always been war. There is no period in history where we didn't have wars of some sort. Politicians like to blame somebody and it's easier to blame foreigners, so as tensions rise people will blame foreigners more and more.

Also, I'm told throughout history when you have shortages of raw materials, that leads to strife and wars and we have shortages of raw materials developing which will be bigger and bigger. So we will have wars. - in Daily Bell"

at http://jimrogers1.blogspot.com/2012/11/jim-rogers-we-will-have-wars.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Richard Russell - Bursting Bubbles Will Make Things Far Worse

"With gold, silver and stocks on the move, the Godfather of newsletter writers, Richard Russell, issued this

warning in a note to subscribers: “I continue to

believe that we are in a primary bear market, one that is, and has been,

disguised by the Federal Reserve's series of QEs. Bernanke's theory is that if

the Fed creates enough “money,” then sooner or later deflation and sluggish

growth must turn into inflation and faster growth.”

Richard Russell

continues:

“The problem with Bernanke's theory is that the

economic world is caught in a massive world-wide cycle of deflation -- more

goods produced than can be consumed. Normally, the deflationary trend would

fully express itself through a primary bear market that would get rid of the

weak hands and those who don't deserve to survive. This would result in stocks

declining to the point where they would once again represent great values.

The theory espoused by the world's central banks is

that they can control the planet's economic cycles. Actually, I believe what is

happening is that the seemingly endless flood of fiat currency is creating a

series of bubbles, which, in the course of time, is fated to burst. The

bursting of these various bubbles will result in the bear market being far worse

than would otherwise have been the case. As Shakespeare put it, “What fools

these mortals be.”

Following the 1929 crash, the stock market embarked

on a huge recovery that lasted into early 1930. Most present-day analysts are

very familiar with the 1929-30 episode. So today's stock market had to do

something different in order to draw retail investors (and pros) back in to the

market.

What the market did this time was to produce an even

bigger and longer-lasting post-crash recovery. The recovery has lasted far

longer than most experts expected and has carried the Dow within 500 points of

its 2007 record high.

The 2008-09 bear market decline was swift and

violent. It was over almost before most investors knew what had hit them.

According to the law of alternation, the next bear market decline should be just

the opposite in character of the 2008-09 decline. The next decline should be

slow and lazy, with stocks sinking in a deceptive, leisurely manner, sinking in

a lazy way that scares nobody.”

“The US gold coverage ratio, which measures the

amount of gold on deposit at the Federal Reserve against the total money supply,

is currently at an all-time low of 17%. This ratio tends to move dramatically

and falls during periods of disinflation or relative price stability. The

historical average for the gold coverage ratio is roughly 40%, meaning that the

price of gold would have to more than double to reach the average. The gold

coverage ratio has been there twice during the twentieth century. Were this to

happen today, the value of an ounce of gold would exceed $12,000.” Scott Minerd,

analyst, courtesy Investment Rarities, Inc."

Wednesday, November 28, 2012

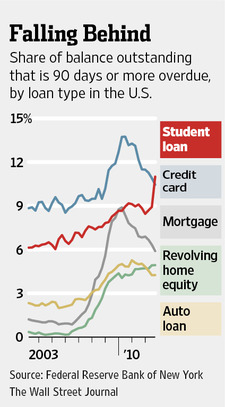

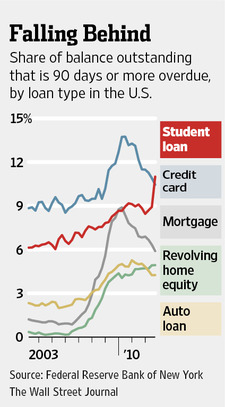

Escalating Delinquency Rates Make Student Loans Look Like the New Subprime

"Now that student loans are undeniably in bubble territory, the officialdom is starting to wake up and take notice. Evidence that students were taking on so much debt as a group that it was undermining their ability to be Good American Consumers wasn’t enough. A recent New York Fed study found that 94% of recent graduates had borrowed to help pay for their education, and average debt levels among student borrowers is $23,000. Remember, that average includes seasoned borrowers, who presumably borrowed less and also in many cases reduced the principal amount of their loans, so the average amount borrowed by recent grads is certain to be higher. Student debt is senior to all other consumer debt; unlike, say, credit card balances, Social Security payments can be garnished to pay delinquencies. As a result, it has contributed to the fall in the homeownership rate, since many young people who want to buy a house can’t because their level of student debt prevents them from getting a mortgage.

But despite some pious noises about the burden that student loans place on young Americans, there’s been no willingness in the officialdom to do much about it. But that may finally be changing. The latest Federal Reserve data is grim.

Student loan delinquencies are getting into nosebleed territory. The Wall Street Journal, citing New York Fed data, tells us that student debt outstanding increased 4.6% in the last quarter. Repeat: in the last quarter. Annualized, that’s a 19.7% rate of increase* during a period when other consumer borrowings were on the decline. And this growth is taking place while borrower distress is becoming acute. 11% of the loans were 90+ days delinquent, up from 8.9% at the close of last quarter. The underlying credit picture is certain to be worse, since many borrowers aren’t even required to service loans (as in they are still in school or have gotten a postponement, which is available to the unemployed for a short period). And it was the only type of consumer debt to show rising delinquency rates.

This is the new subprime: escalating borrowing taking place as loan quality is lousy and getting worse. And in keeping with parallel to subprime, one of the big reasons is, to use a cliche from that product, anyone who can fog a mirror can get a loan..."

at http://www.nakedcapitalism.com/2012/11/escalating-delinquency-rates-make-student-loans-look-like-the-new-subprime.html#7wkEfl2lAKM5qM5E.99

But despite some pious noises about the burden that student loans place on young Americans, there’s been no willingness in the officialdom to do much about it. But that may finally be changing. The latest Federal Reserve data is grim.

Student loan delinquencies are getting into nosebleed territory. The Wall Street Journal, citing New York Fed data, tells us that student debt outstanding increased 4.6% in the last quarter. Repeat: in the last quarter. Annualized, that’s a 19.7% rate of increase* during a period when other consumer borrowings were on the decline. And this growth is taking place while borrower distress is becoming acute. 11% of the loans were 90+ days delinquent, up from 8.9% at the close of last quarter. The underlying credit picture is certain to be worse, since many borrowers aren’t even required to service loans (as in they are still in school or have gotten a postponement, which is available to the unemployed for a short period). And it was the only type of consumer debt to show rising delinquency rates.

This is the new subprime: escalating borrowing taking place as loan quality is lousy and getting worse. And in keeping with parallel to subprime, one of the big reasons is, to use a cliche from that product, anyone who can fog a mirror can get a loan..."

at http://www.nakedcapitalism.com/2012/11/escalating-delinquency-rates-make-student-loans-look-like-the-new-subprime.html#7wkEfl2lAKM5qM5E.99

The Giant Currency Superstorm That Is Coming To The Shores Of America When The Dollar Dies

"By recklessly printing, borrowing and spending money, our authorities are

absolutely shredding confidence in the U.S. dollar. The rest of the world is

watching this nonsense, and at some point they are going to give up on the U.S.

dollar and throw their hands up in the air. When that happens, it is going to

be absolutely catastrophic for the U.S. economy. Right now, we export a lot of

our inflation. Each year, we buy far more from the rest of the world than

they buy from us, and so the rest of the world ends up with giant piles of

U.S. dollars. This works out pretty well for them, because the U.S. dollar is

the primary reserve currency of the world and is used in international trade far

more than any other currency is. Back in 1999, the percentage of foreign

exchange reserves in U.S. dollars peaked at 71 percent, and since then it has slid back to 62.2 percent. But that is still an overwhelming amount. We

can print, borrow and spend like crazy because the rest of the world is there to

soak up our excess dollars because they need them to trade with one another.

But what will happen someday if the rest of the world decides to reject the U.S.

dollar? At that point we would see a tsunami of U.S. dollars come flooding back

to this country. Just take a moment and think of the worst superstorm that you

can possibly imagine, and then replace every drop of rain with a dollar bill.

The giant currency superstorm that will eventually hit this nation will be far

worse than that..."

at http://theeconomiccollapseblog.com/archives/the-giant-currency-superstorm-that-is-coming-to-the-shores-of-america-when-the-dollar-dies

at http://theeconomiccollapseblog.com/archives/the-giant-currency-superstorm-that-is-coming-to-the-shores-of-america-when-the-dollar-dies

Comex Open Saw 24 Tonnes of Paper Gold Dumped at Market

"I am open to other possibilities, but it certainly looks like the Dr. Evil strategy being employed for the Comex post-option expiration in which a large number of call options are turned into active December futures contracts. I suggested that this might happen yesterday given the way in which the option market closed.

But I am sure Bart Chilton and the stalwarts at the CFTC have already identified the seller, and examined their selling motivations and the size and placement of their 'fat finger,' and will let us know about it four or five years from now.

But I am sure Bart Chilton and the stalwarts at the CFTC have already identified the seller, and examined their selling motivations and the size and placement of their 'fat finger,' and will let us know about it four or five years from now.

"Gold saw a massive 24 tonne sell order (7,800 contracts) at 08:20 a.m. New York time - bang on the opening of the world's largest gold exchange - which a fall of 2.25% in the market price.at http://jessescrossroadscafe.blogspot.com/2012/11/comex-open-saw-24-tonnes-of-paper-gold.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JessesCafeAmericain+%28Jesse%27s+Caf%C3%A9+Am%C3%A9ricain%29

If the selling was year-end profit-taking then it was inept. Dealers try and finesse big sell orders into the market to get the best (highest) price for the biggest volume they can and thereby optimize profit - that requires stealth. If on the other hand it was a "fat finger" episode as has been suggested with a broker said to be looking to roll his December gold futures contract then it was even more inept.

More likely this could be a short play, with the seller looking to trigger stops below the market at $1730 and thus extend the move significantly lower and thus increase his profits. If so, he certainly caught the market on the hop as the move is counter-intuitive with everything else that is going on in the economy..."

Tuesday, November 27, 2012

Behavioral Finance: Inside the Client’s Brain

"I admit to a prurient interest in behavioral finance. Perhaps this is due to my background in psychology—or just from having dealt with a broad range of clients for many years. Investor behavior is sometimes amazing, and behavioral finance, the academic specialty that has grown up to examine it, is equally interesting. One of the most practical discussions of behavioral finance I have seen appeared recently on AdvisorOne. It was written by Michael Finke, the coordinator for the financial planning program at Texas Tech.

It is my strong recommendation that you read the entire article, but here are a few of the behavioral finance highlights that jumped out at me:

Source: Lean Frog (click on image to enlarge)

at http://systematicrelativestrength.com/2012/11/27/behavioral-finance-inside-clients-brain/

It is my strong recommendation that you read the entire article, but here are a few of the behavioral finance highlights that jumped out at me:

The biggest impediment to good returns is typically investor psychology. If behavioral finance ideas can help clients control their behavior better—and thus lead to better investment outcomes—some of these ideas may prove useful."

- Breaking habits requires deliberate intention to change routines by using our rider to change the direction of the elephant. How do we motivate people to change behavior to meet long-term goals? Neuroscience suggests that the worst way to motivate people is to focus on numbers. Telling someone they need to save a certain amount to achieve an adequate retirement accumulation goal may be convincing to the rational brain, but not so convincing to the elephant.

- Explaining a concept in a visual or emotional sense uses much more of our brain functions than is used by numbers. If you think of people as being emotional and visual, you’ve essentially tapped into 70% of the brain real estate. There is that rational side, but that rational side might be more like 20% of the real estate. The rational side used to solve math problems might be 8% of the real estate.

- It can be useful to frame desired actions as the status quo in order to take advantage of this preference. For example, setting defaults that are beneficial can have an unexpectedly large impact on improving behavior.

- The most powerful emotional response related to financial choice is fear. Fear leads to a number of observed decision anomalies identified in behavioral finance such as the excessive attention paid to a loss. Framing decisions so that they do not necessarily involve a loss is an important tool advisors can use to avoid bringing the amygdala to the table.

- “Dollar cost averaging is an illusion,” notes James. “Unless we have mean reversion in the market (and if we do we can make lots of market timing bets and make ourselves rich), dollar cost averaging does not work. But if people believe that they are buying shares cheaper in a recession, the story makes people stay in the market at the times when their fear-driven emotional side wants them to get out of the market. We have a story that, even if it’s completely false, is generating the behavior that is going to be portfolio maximizing in the end. So maybe the answer to the usefulness of dollar cost averaging isn’t ‘well we’ve figured it out and it doesn’t work, so don’t use it,’ the answer is ‘actually it’s not true but it gets your clients to behave the right way so keep telling them that.’”

Source: Lean Frog (click on image to enlarge)

at http://systematicrelativestrength.com/2012/11/27/behavioral-finance-inside-clients-brain/

Turk - The LBMA Is Moving To Cover Up Silver Manipulation

"Today

James Turk spoke with King World News about steps which are being taken by the

LBMA and Western central planners to cover up the corruption and manipulation in

the gold and silver markets. This is the first in a series of interviews with

James Turk that will be released today which reveals what is going on behind the

scenes of the increasingly desperate Western central bank gold and silver price

suppression scheme.

Here is what Turk had to say about what is now taking place:

“They (the LBMA) are making it more and more

opaque. Less and less information is being made available. Specifically,

what’s happened here is that the LBMA had been reporting the silver lending rate

and comparing it to the LIBOR rate.”

“For the past couple of years I have contended that

this was a fictitious rate because, in reality, I believe silver is in

backwardation. In other words, the future months are below the spot months, and

so you should have a negative silver forward rate. But it’s not reported that

way on the LBMA site.

They (the LBMA) consistently show a positive silver

forward rate. Now, what the LBMA said is they are no longer going to report

silver interest rates and silver forward rates.....

“The reason they (the LBMA) gave is they said it is

just an indication and you can’t really trade at that price anyway.

So what that does is prove the point that I’ve been

making, that these are artificial rates which are just there to paint the tape

and to mislead people into thinking the silver market is actually in a normal

contango. But in reality it (silver) is actually in backwardation.”

Eric King: “These are the types of things you see James as you are running a

price fixing scheme, and it’s a Ponzi scheme, and you begin to run into

trouble.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/27_Turk_-_The_LBMA_Is_Moving_To_Cover_Up_Silver_Manipulation.htmlLeeb - Gold, Silver & Natural Gas Are Going To Soar

"...When I watch what is happening I keep wondering, how

much money is the Fed going to print? And when does inflation really start to

take hold? It’s just a matter of time, Eric. The endgame here is just more

money printing to keep the economy going.

As the world really begins to look seriously at the

energy problems we face going forward, governments will start to realize the

strategic importance of silver. Silver is a better buy than gold. Silver is

going to play a vital role in producing energy around the globe. Japan is

turning to solar. Saudi Arabia is turning to solar. Virtually every major

country in the world is turning to solar. There is not going to be enough

silver to satisfy the demand for solar energy.

Silver has not broken $50 yet, but when I say silver

is going to be a 3-digit commodity, it will be. These small silver stocks, they

are the ones that are really going to be a big hit. What really worries me

about silver, Milton Friedman said silver was the first monetary metal. Silver

will benefit from the monetary catastrophe that is in front of us because it is

a monetary metal. But silver is also needed for cell phones, energy, computers,

automobiles and so on.

A Stanford professor, Mark Jacobson, wrote a cover

story in Scientific American in late 2009. He said that in order for the world

to ween itself from hydrocarbons, we are going to need four or five terawatts of

electricity. The amount of silver that would be needed for that is more than

exists in the ground.

So in the future when silver is well above $100 an

ounce, you are likely to see governments saying to people, ‘You can’t buy silver

anymore.’ The price of silver will be going ballistic, but the mines will

continue to produce because the governments will continue to need every ounce of

silver they can get.

The bottom line is we are looking at the beginning of

what’s likely to be a massive boom in these monetary metals, but silver, in

particular, is really going to soar.”

Monday, November 26, 2012

Welcome to the Currency War, Part 5: The Dollar Gets Serious Competition

"Not so long ago the dollar was the world’s only reserve currency. Everything else was one (or several) steps down in terms of safety and liquidity, and major financial institutions acted accordingly, accumulating dollars for the risk-free parts of their portfolios. Global demand for dollars was, as a result, effectively infinite, which meant the US could borrow whatever it wanted, secure in the knowledge that the Treasury bonds it created would find willing buyers.

But quietly, over the past couple of decades, the dollar has been joined at the top by the euro, yen, pound sterling and Swiss franc. And now the list of legitimate reserve currencies has expanded to include Canadian and Australian dollars:...

Note that the Chinese renminbi (aka the yuan) and Singapore dollar aren’t on the list. But they will be soon, with China now the second biggest economy (and an aggressive importer of gold) and Singapore becoming the preferred destination of global savings (especially gold storage) now that Switzerland has been cracked by the IRS and other tax authorities. See China’s next step in yuan overhaul is convertibility.

Gold, meanwhile, is once again being accumulated rather than dumped by central banks, and has already, arguably, replaced the dollar as the most coveted reserve asset. This, by the way, is simply a return after a 40-year absence to the place gold has occupied since the beginning of recorded history.

What does this mean for the dollar? First, a lot of central banks and trading firms will sell dollars to buy those other currencies and gold in order to make their portfolios reflect evolving financial realities. That selling pressure will, other things being equal, lower the dollar’s relative value, which is another way of saying that the US might not be able to borrow infinite amounts of money going forward, forcing us to either cut annual deficits far faster than is currently planned or pay a higher interest rate on future borrowings, which would increase future deficits.

The US, in short, will finally be subject to the same economic laws as lesser countries, with the same result: excessive debt and money printing lead to currency crisis which leads to depression."

at http://dollarcollapse.com/currency-war-2/welcome-to-the-currency-war-part-5-the-dollar-is-now-one-of-many/

But quietly, over the past couple of decades, the dollar has been joined at the top by the euro, yen, pound sterling and Swiss franc. And now the list of legitimate reserve currencies has expanded to include Canadian and Australian dollars:...

Note that the Chinese renminbi (aka the yuan) and Singapore dollar aren’t on the list. But they will be soon, with China now the second biggest economy (and an aggressive importer of gold) and Singapore becoming the preferred destination of global savings (especially gold storage) now that Switzerland has been cracked by the IRS and other tax authorities. See China’s next step in yuan overhaul is convertibility.

Gold, meanwhile, is once again being accumulated rather than dumped by central banks, and has already, arguably, replaced the dollar as the most coveted reserve asset. This, by the way, is simply a return after a 40-year absence to the place gold has occupied since the beginning of recorded history.

What does this mean for the dollar? First, a lot of central banks and trading firms will sell dollars to buy those other currencies and gold in order to make their portfolios reflect evolving financial realities. That selling pressure will, other things being equal, lower the dollar’s relative value, which is another way of saying that the US might not be able to borrow infinite amounts of money going forward, forcing us to either cut annual deficits far faster than is currently planned or pay a higher interest rate on future borrowings, which would increase future deficits.

The US, in short, will finally be subject to the same economic laws as lesser countries, with the same result: excessive debt and money printing lead to currency crisis which leads to depression."

at http://dollarcollapse.com/currency-war-2/welcome-to-the-currency-war-part-5-the-dollar-is-now-one-of-many/

Close To The Tipping Point For The Chaotic Phase To Begin

"Today 40-year veteran, Robert Fitzwilson, wrote the following

piece exclusively for King World News. Fitzwilson, who is founder of The

Portola Group, warns that “Cracks are developing in the fabric of societies around the

world ... It feels like we are getting very close to the tipping point for the

chaotic phase to begin.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/25_Close_To_The_Tipping_Point_For_The_Chaotic_Phase_To_Begin.html

Below is Fitzwilson’s

exclusive piece for KWN:

“Gravity is a mysterious force. We can measure it,

and we can experience it. Our very existence would not be possible without it.

There are many theories as to the origin of gravity, but none that have been

proven conclusively.

If we

then turn to look at the global experience with fiat money, we know it is coming

to an end. The arithmetic is inescapable. History is very clear about that.

We have concluded that the “when” conundrum cannot be answered with any

certainty. The end is unlikely to be linear, most likely chaotic and will

accelerate rapidly to the final conclusion...."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/25_Close_To_The_Tipping_Point_For_The_Chaotic_Phase_To_Begin.html

Sunday, November 25, 2012

GRANTHAM: Here Are The Basic Forces That Will Send Growth To Near-Zero For Decades

"Jeremy Grantham recently released his quarterly letter to GMO clients.

Titled On The Road To Zero Growth, the note was pretty depressing.

Grantham sees real US GDP growth trending at 0.9 percent through 2030, then falling to 0.4 percent from 2030 to 2050.

"Someday, when the debt is repaid and housing is normal and Europe has settled down, most business people seem to expect a recovery back to America’s old 3.4% a year growth trend, or at least something close," he wrote. "They should not hold their breath.

"A declining growth trend is inevitable and permanent and is caused by some pretty basic forces."

Those basic forces include unfavorable demographic trends, decelerating productivity growth, tightening resource constraints, and rising environmental costs.

These are trends that have been developing for years. However, they have gone unnoticed thanks to the tech, housing, and financial booms and busts of the last ten or so years..."

at http://www.businessinsider.com/grantham-on-the-road-to-zero-growth-2012-11?op=1#ixzz2DGeZgp9X

Titled On The Road To Zero Growth, the note was pretty depressing.

Grantham sees real US GDP growth trending at 0.9 percent through 2030, then falling to 0.4 percent from 2030 to 2050.

"Someday, when the debt is repaid and housing is normal and Europe has settled down, most business people seem to expect a recovery back to America’s old 3.4% a year growth trend, or at least something close," he wrote. "They should not hold their breath.

"A declining growth trend is inevitable and permanent and is caused by some pretty basic forces."

Those basic forces include unfavorable demographic trends, decelerating productivity growth, tightening resource constraints, and rising environmental costs.

These are trends that have been developing for years. However, they have gone unnoticed thanks to the tech, housing, and financial booms and busts of the last ten or so years..."

at http://www.businessinsider.com/grantham-on-the-road-to-zero-growth-2012-11?op=1#ixzz2DGeZgp9X

More Filings From Large & Influential Investors Buying Gold

"Today one of the wealthiest men in the resource space said that

in the very near future we should expect more filings from large and influential

investors buying gold. Here is what Rule had to say: “We just had

reports that both Paulson and Soros have been adding to their gold positions,

which now total roughly $4 billion. It doesn’t surprise me that they are adding

to positions. My suspicion is that in the coming months we are going to see

more reports of large and influential investors doing the same thing.”

Today one of the wealthiest men in the resource space said that

in the very near future we should expect more filings from large and influential

investors buying gold. Here is what Rule had to say: “We just had

reports that both Paulson and Soros have been adding to their gold positions,

which now total roughly $4 billion. It doesn’t surprise me that they are adding

to positions. My suspicion is that in the coming months we are going to see

more reports of large and influential investors doing the same thing.”

“Certainly Mr. Paulson and Mr. Soros have to deal

with large amounts of money. The fact that they are very prescient investors,

both of them, in terms of futures markets and currency markets, probably adds to

the reasons why they feel comfortable betting on gold.

Their traditional areas are so volatile and risky, so

I understand the move. What I find interesting is the timing of the increase

and what it says about the likely direction of the price of gold going

forward.

I have told you that quantitative easing is simply

counterfeiting and it is happening around the world. One of the reasons why we

have seen so little volatility in the global markets is there is so much cash

around because of the printing.

The central bank officials know this, and they are

very leery about cutting off that source of cash to the market because they want

the markets to stay quiet. This is coordinated action to some degree, but

governments around the world are engaged in currency wars and competitive

devaluations.

These governments want their currencies lower. They

want to maintain whatever competitiveness is left in their economies. They also

want to reduce growing unemployment. They are also using the newly

counterfeited money to buy newly issued bonds in order to keep up with their

spending programs.

So the reality is these countries can’t stop

quantitative easing. Their failure to stop quantitative easing is naturally

leading to more gold buying. This environment could not be more friendly to

gold bulls and I fully expect higher prices going forward.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/23_More_Filings_From_Large_%26_Influential_Investors_Buying_Gold.htmlFriday, November 23, 2012

The Black Market For Gold Is Booming

"According to Assistant Central Bank Governor Manuel Torres, who heads the bank’s refinery operations, as much as 95% of all the gold mined in the Philippines is now being sold to smugglers and moved out of the country illegally.

And the trend has been accelerating. In 2011, central bank gold purchases dropped at an annualized rate of 4%, then 76%, then 88% during the second, third, and fourth quarters. In the first quarter of 2012, gold purchases were down 92%. It’s staggering.

Most of this smuggled gold finds its way here to Hong Kong, and then onward to China, where there is a voracious demand for gold despite rising prices.

Of course, it’s perfectly legal to bring gold, tax-free, into Hong Kong. This is why when Hong Kong reports its official trade statistics, ‘gold imports’ from the Philippines are 30 times higher than what the Philippines government reports as ‘gold exports’ to Hong Kong!

It’s an enormous discrepancy, and it gives a huge indication of how much gold smuggling is really going on.

And it’s not just the Philippines either; small-scale mining activity is being pushed to the black market in many countries around the world..."

at http://www.sovereignman.com/expat/the-thriving-black-market-for-gold-10021/#ixzz2D57Ov2VG

And the trend has been accelerating. In 2011, central bank gold purchases dropped at an annualized rate of 4%, then 76%, then 88% during the second, third, and fourth quarters. In the first quarter of 2012, gold purchases were down 92%. It’s staggering.

Most of this smuggled gold finds its way here to Hong Kong, and then onward to China, where there is a voracious demand for gold despite rising prices.

Of course, it’s perfectly legal to bring gold, tax-free, into Hong Kong. This is why when Hong Kong reports its official trade statistics, ‘gold imports’ from the Philippines are 30 times higher than what the Philippines government reports as ‘gold exports’ to Hong Kong!

It’s an enormous discrepancy, and it gives a huge indication of how much gold smuggling is really going on.

And it’s not just the Philippines either; small-scale mining activity is being pushed to the black market in many countries around the world..."

at http://www.sovereignman.com/expat/the-thriving-black-market-for-gold-10021/#ixzz2D57Ov2VG

World Gold Council's Grubb: Gold To Continue Higher In 2013 Amid China Recovery, Record Central Bank Buying

"Hard Assets Investor: Central bank gold demand looked strong

again last quarter and seems on pace to exceed last year’s five-decade high.

Which central banks are buying? And what influences their purchase decision?

Marcus Grubb: Yes, absolutely. On the face of it, central bank net purchases of gold fell 31 percent when compared with Q3 2011. But actually, 97.6 tons is a great number. And it means that through the end of September, this year is an even better year than last year; and last year was a record year. To the end of September, central banks have now bought 373.9 tons. Last year through September, they bought 343.9. So we’re looking at another 450-500-ton year for central banks, which is a record since the ’60s.

The most recent name that’s popped in, after many years of not buying gold, is Brazil. Brazil’s buying confirms a trend we’ve seen. If you look back over this year and in this quarter, the buyers are Latin American countries — Mexico, Bolivia, now Brazil; they are Central Asian countries — Russia, Kazakhstan, Ukraine; and Far Eastern countries such as Thailand, Philippines and South Korea. The developing country central banks are the ones doing the purchasing.

The interesting thing about them is, on average, their weightings to gold are much lower than the U.S. and European central banks — usually under 10 percent of foreign exchange reserves in gold. And, in many cases, less than 5.

The other conundrum to always keep in mind is that China has made no public statements about its gold reserves in three to four years. Ostensibly, they're still at 1064 tons, about 1.8 percent of foreign exchange reserves, which is extremely low by international standards. But we don’t have any new data on China currently.

The bottom line is that these central banks are diversifying away from the dollar. And they are diversifying away from the euro because of the sovereign problems and the currency issues in Europe.

Moreover, they are diversifying away from sovereign debt. We’ve seen the sovereign debt issue raise its head last year in the U.S and, of course in Europe, we’ve got countries that are effectively insolvent, being propped up by bailouts..."

at http://seekingalpha.com/article/1025821-world-gold-council-s-grubb-gold-to-continue-higher-in-2013-amid-china-recovery-record-central-bank-buying?source=feed

Marcus Grubb: Yes, absolutely. On the face of it, central bank net purchases of gold fell 31 percent when compared with Q3 2011. But actually, 97.6 tons is a great number. And it means that through the end of September, this year is an even better year than last year; and last year was a record year. To the end of September, central banks have now bought 373.9 tons. Last year through September, they bought 343.9. So we’re looking at another 450-500-ton year for central banks, which is a record since the ’60s.

The most recent name that’s popped in, after many years of not buying gold, is Brazil. Brazil’s buying confirms a trend we’ve seen. If you look back over this year and in this quarter, the buyers are Latin American countries — Mexico, Bolivia, now Brazil; they are Central Asian countries — Russia, Kazakhstan, Ukraine; and Far Eastern countries such as Thailand, Philippines and South Korea. The developing country central banks are the ones doing the purchasing.

The interesting thing about them is, on average, their weightings to gold are much lower than the U.S. and European central banks — usually under 10 percent of foreign exchange reserves in gold. And, in many cases, less than 5.

The other conundrum to always keep in mind is that China has made no public statements about its gold reserves in three to four years. Ostensibly, they're still at 1064 tons, about 1.8 percent of foreign exchange reserves, which is extremely low by international standards. But we don’t have any new data on China currently.

The bottom line is that these central banks are diversifying away from the dollar. And they are diversifying away from the euro because of the sovereign problems and the currency issues in Europe.

Moreover, they are diversifying away from sovereign debt. We’ve seen the sovereign debt issue raise its head last year in the U.S and, of course in Europe, we’ve got countries that are effectively insolvent, being propped up by bailouts..."

at http://seekingalpha.com/article/1025821-world-gold-council-s-grubb-gold-to-continue-higher-in-2013-amid-china-recovery-record-central-bank-buying?source=feed

Richard Russell - Attempts To Defeat Deflation As Money Dies

"With gold and silver surging, the

Godfather of newsletter writers, Richard Russell, warns about attempts to defeat

deflation as money dies. Here are Russell’s thoughts, along with some charts,

in a note to subscribers: “Help, I'm alone. Where

are my fellow newsletter writers: Stan Weinstein, Garfield Drew, Sir Harry

Schultz, Marty Zweig, Chuck Almon, Bob Farrell? They all flew the coop while

poor old Richard Russell is still carrying on. Maybe it's because the stock

market has become impossible or irrational. I think at any given time, the

stock market seems increasingly difficult to figure out.”

Richard Russell

continues:

“I think what's needed is a lot of patience. Sooner

or later the stock market will show its hand. At this juncture, we have the

pressure of world deflation weighing on ALL the markets. Against that, we have

the various central banks trying to print us into prosperity and at the same

time trying to defeat deflation.

How do you battle deflation? Easy, you print fiat

money until deflation backs off and until signs of inflation appear. But what

happens when you print to kingdom come, and inflation refuses to appear? Well,

in that case your junk currency sinks to near-nothingness, and you leave the

whole deflation problem to the next generation of devaluing geniuses.

I ask myself, why hold any dollars at all? What's

the danger of holding everything in dollars? And my answer is -- when it comes

to investing, nothing is certain. Sure, it looks as though Fed printing (now

that Obama is in for another four years) will continue for the next four years

or, at least, until Bernanke is convinced that he has defeated deflation.

Wait, what could cause Bernanke to halt flooding the

system with his fiat notes? I think runaway inflation in tangible goods and

political pressure could halt the Fed's wholesale manufacturing of Fed notes.

Scandalous bubbles might appear. Bubbles in college costs, bubbles in medical,

bubbles in collectibles, bubbles, in insurance costs, bubbles in food prices,

bubbles in energy costs, bubbles in consumer optimism. Of course, none of this

would appear in the Labor Department's phony CPI statistics. As we all know,

figures don't lie, but liars can figure..."

Wednesday, November 21, 2012

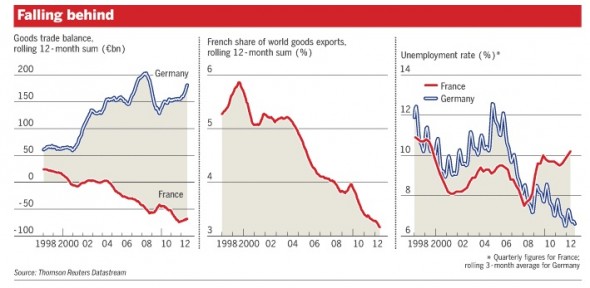

A Brutal German Takedown Of The French Economy

"It’s certainly bizarre. For a while now, experts and researchers have been giving us the bad news, each bit worse than the last, about the crisis countries of southern Europe. And, throughout, the talk has been of “core Europe,” held by the “Franco-German motor” that must under no circumstances be allowed to stammer.

But now, in the face of France’s increasing lack of competitiveness and horrendous public debt (currently at 90% of GDP), a question arises: are we dealing with a communication disaster here, naive blindness all around – or is this perhaps one last Pyrrhic victory for that supremely French art of smoke and mirrors?

How much taxpayer money has been wasted – also in Germany – with ridiculous conferences and research projects geared to furthering post-World War II “Franco-German reconciliation!”

The reconciliation became a reality long ago, and the fact is that neither country gives much of a damn about the other. No need for conferences to establish that, and well enough could be left alone if it weren’t for the fact that France, Germany’s neighbor, is on a course to becoming the next crisis country.

So, once again: why wasn’t anybody paying closer attention? An unintentional and indirect explanation was delivered two weeks ago by the former CEO of aerospace group EADS, Louis Gallois, in his damning diagnosis of the French economy and call for incisive reforms. A "competitiveness shock" was needed, said Gallois who forged his own business career on the back of lucrative government contracts..."

at http://www.worldcrunch.com/business-finance/rotten-at-europe-039-s-quot-core-quot-a-pitiless-german-takedown-of-modern-france/france-germany-economy-die-welt/c2s10211/#.UKz2COOe_DN#ixzz2CtNNWzHX

But now, in the face of France’s increasing lack of competitiveness and horrendous public debt (currently at 90% of GDP), a question arises: are we dealing with a communication disaster here, naive blindness all around – or is this perhaps one last Pyrrhic victory for that supremely French art of smoke and mirrors?

How much taxpayer money has been wasted – also in Germany – with ridiculous conferences and research projects geared to furthering post-World War II “Franco-German reconciliation!”

The reconciliation became a reality long ago, and the fact is that neither country gives much of a damn about the other. No need for conferences to establish that, and well enough could be left alone if it weren’t for the fact that France, Germany’s neighbor, is on a course to becoming the next crisis country.

So, once again: why wasn’t anybody paying closer attention? An unintentional and indirect explanation was delivered two weeks ago by the former CEO of aerospace group EADS, Louis Gallois, in his damning diagnosis of the French economy and call for incisive reforms. A "competitiveness shock" was needed, said Gallois who forged his own business career on the back of lucrative government contracts..."

at http://www.worldcrunch.com/business-finance/rotten-at-europe-039-s-quot-core-quot-a-pitiless-german-takedown-of-modern-france/france-germany-economy-die-welt/c2s10211/#.UKz2COOe_DN#ixzz2CtNNWzHX

Is there an Asian RMB bloc?

"...The first interesting commentary is a paper by Arvind Subramanian and Martin Kessler, both from the Peterson Institute, arguing that a RMB currency bloc is rising in Asia and is displacing the US dollar. According to the abstract:

A country’s rise to economic dominance tends to be accompanied by its currency becoming a reference point, with other currencies tracking it implicitly or explicitly. For a sample comprising emerging market economies, we show that in the last two years, the renminbi has increasingly become a reference currency which we define as one which exhibits a high degree of co-movement (CMC) with other currencies.The RMB, the authors claim, is well on its way to eclipsing the US dollar as the dominant reserve currency. In an OpEd piece in the Financial Times the authors explain their reasoning a little more, going on to say:

In East Asia, there is already a renminbi bloc, because the renminbi has become the dominant reference currency, eclipsing the dollar, which is a historic development. In this region, 7 currencies out of 10 co-move more closely with the renminbi than with the dollar, with the average value of the CMC relative to the renminbi being 40 percent greater than that for the dollar.

We find that co-movements with a reference currency, especially for the renminbi, are associated with trade integration. We draw some lessons for the prospects for the renminbi bloc to move beyond Asia based on a comparison of the renminbi’s situation today and that of the Japanese yen in the early 1990s. If trade were the sole driver, a more global renminbi bloc could emerge by the mid-2030s but complementary reforms of the financial and external sector could considerably expedite the process.

In new research, we find that since the global financial crisis, as the US and Europe have struggled economically, the renminbi has increasingly become a reference currency (meaning emerging market exchange rates move closely with it). In fact, since June 2010 when the renminbi resumed floating, the number of currencies tracking it has increased compared with the earlier period of flexibility between July 2005 and 2008. Over the same period, the number tracking the euro and the dollar declined.at http://www.creditwritedowns.com/2012/11/is-there-an-asian-rmb-bloc.html?utm_source=rss&utm_medium=rss&utm_campaign=is-there-an-asian-rmb-bloc

East Asia is now a renminbi bloc because the currencies of seven out of 10 countries in the region – including South Korea, Indonesia, Taiwan, Malaysia, Singapore and Thailand – track the renminbi more closely than the US dollar. For example, since the middle of 2010, the Korean won and the renminbi have appreciated by similar amounts against the dollar. Only three economies in the group – Hong Kong, Vietnam and Mongolia – still have currencies following the dollar more closely than the renminbi."

The Age of Financial Repression

"Following his re-election, US President Barack Obama almost immediately turned his attention to reining in America’s rising national debt. In fact, almost all Western countries are implementing policies aimed at reducing – or at least arresting the growth of – the volume of public debt.

at http://www.project-syndicate.org/commentary/western-governments--increasing-use-of-financial-repression-by-sylvester-eijffinger-and-edin-mujagic#ZJOkowuJ8eRwm0KG.99

In their widely cited paper “Growth in a Time of Debt,” Kenneth Rogoff and Carmen Reinhart argue that, when government debt exceeds 90% of GDP, countries suffer slower economic growth. Many Western countries’ national debt is now dangerously near, and in some cases above, this critical threshold.

Indeed, according to the OECD, by the end of this year, America’s national debt/GDP ratio will climb to 108.6%. Public debt in the eurozone stands at 99.1% of GDP, led by France, where the ratio is expected to reach 105.5%, and the United Kingdom, where it will reach 104.2%. Even well disciplined Germany is expected to close in on the 90% threshold, at 88.5%.

Countries can reduce their national debt by narrowing the budget deficit or achieving a primary surplus (the fiscal balance minus interest payments on outstanding debt). This can be accomplished through tax increases, government-spending cuts, faster economic growth, or some combination of these components.

When the economy is growing, automatic stabilizers work their magic. As more people work and earn more money, tax liabilities rise and eligibility for government benefits like unemployment insurance falls. With higher revenues and lower payouts, the budget deficit diminishes.

But in times of slow economic growth, policymakers’ options are grim. Increasing taxes is not only unpopular; it can be counter-productive, given already-high taxation in many countries. Public support for spending cuts is also difficult to win. As a result, many Western policymakers are seeking alternative solutions – many of which can be classified as financial repression.

Financial repression occurs when governments take measures to channel to themselves funds that, in a deregulated market, would go elsewhere. For example, many governments have implemented regulations for banks and insurance companies that increase the amount of government debt that they own..."

at http://www.project-syndicate.org/commentary/western-governments--increasing-use-of-financial-repression-by-sylvester-eijffinger-and-edin-mujagic#ZJOkowuJ8eRwm0KG.99

Doorsteps of a Currency Crisis; Economic Illiterates Debate Monetary Policy; Monetarist Mush

"Japan's grand experiment of decades-long QE coupled with Keynesian foolishness is about to take one last gigantic leap forward before it plunges straight off the cliff into a massive currency crisis.

Please consider the New York Times article A Call for Japan to Take Bolder Monetary Action

Please consider the New York Times article A Call for Japan to Take Bolder Monetary Action

For years, proponents of aggressive monetary policy have offered this unusual piece of advice as a way to end Japan’s deflationary slump and invigorate the economy. Print lots of money, they said. Keep interest rates at zero. Convince the market that Japan will allow inflation for a while.at http://globaleconomicanalysis.blogspot.com/2012/11/doorsteps-of-currency-crisis-economic.html#XUbcdOdDcFBzIGfE.99

Japan’s central bankers long scoffed at such recklessness, which they feared would ignite runaway inflation. But now, the bank’s hand could be forced by an unlikely alliance of economists and lawmakers who have argued for Japan to take more monetary action after more than a decade of weak growth and depressed prices..."

Hyperinflation and Complete Collapse – Nick Barisheff

"Asset manager Nick Barisheff says, “There’s never been a fiat currency in history that didn’t end in hyperinflation and complete collapse.” Barisheff thinks that Treasury Secretary Tim Geithner’s most recent call to have an “unlimited debt ceiling” for the U.S. was “just telling the truth.” That’s essentially what we have now with “open-ended” money printing by the Fed. Barisheff adds, “All it’s doing is postponing a problem . . . it makes it bigger and eventually it blows up.” Forget about remedies for the economy, it’s too late. Barisheff says, “We’ve passed the point of this getting fixed.” Barisheff thinks if the Fed’s gold holdings are ever audited, there will be a “gigantic short-covering rally . . . multiple bankruptcies . . . and a massive loss of confidence” in the dollar because much of the gold is gone or leased out. Barisheff thinks the gold price could be “easily double” right now. That’s because Barisheff believes, “What’s kept the price down is the artificial leased gold going onto the markets.” Join Greg Hunter as he goes One-on-One with Nick Barisheff, CEO of the $650 million Bullion Management Group..."

at http://usawatchdog.com/hyperinflation-and-complete-collapse-nick-barisheff/

at http://usawatchdog.com/hyperinflation-and-complete-collapse-nick-barisheff/

Jim Rogers~US Headed For A Financial Crisis

"Jim Rogers~US Headed For A Financial Crisis , legendary investor talking to Judge Andrew Napolitano about a wide range of subjects touching on economy politics and finance..."

at http://jimrogers1.blogspot.com/2012/11/jim-rogersus-headed-for-financial-crisis.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

at http://jimrogers1.blogspot.com/2012/11/jim-rogersus-headed-for-financial-crisis.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Turk - This Is The Chart That Every Investor Needs To See

"...The following chart illustrates the close correlation

between the S&P 500 and the securities the Federal Reserve is monetizing.

The amount last week is not that big, but even small amounts can impact stock

market prices. Note the small recent uptick in the red line in the

chart.

The important message from this chart, Eric, is that

the stock market is not rising because of good economic activity, which is

understandable. The economy will not be improving until employment starts

growing again. After all, that is what economic activity is all about - people

working and saving or spending the money they earn. And here's the horrific

part..."

Monday, November 19, 2012

President Xi’s Singapore Lessons

"China is at a crucial point today, as it was in 1978, when the market reforms launched by Deng Xiaoping opened its economy to the world – and as it was again in the early 1990’s, when Deng’s famous “southern tour” reaffirmed the country’s development path.

at http://www.project-syndicate.org/commentary/reforming-one-party-rule-in-china-by-michael-spence#uHaavWr8RITt3OVx.99

Throughout this time, examples and lessons from other countries have been important. Deng was reportedly substantially influenced by an early visit to Singapore, where accelerated growth and prosperity had come decades earlier. Understanding other developing countries’ successes and shortcomings has been – and remains – an important part of China’s approach to formulating its growth strategy.

Like Singapore, Japan, South Korea, and Taiwan in their first few decades of modern growth, China has been ruled by a single party. Singapore’s People’s Action Party (PAP) remains dominant, though that appears to be changing. The others evolved into multi-party democracies during the middle-income transition. China, too, has now reached this critical last leg of the long march to advanced-country status in terms of economic structure and income levels.

Singapore should continue to be a role model for China, despite its smaller size. The success of both countries reflects many contributing factors, including a skilled and educated group of policymakers supplied by a meritocratic selection system, and a pragmatic, disciplined, experimental, and forward-looking approach to policy.

The other key lesson from Singapore is that single-party rule has retained popular legitimacy by delivering inclusive growth and equality of opportunity in a multi-ethnic society, and by eliminating corruption of all kinds, including cronyism and excessive influence for vested interests. What Singapore’s founder, Lee Kwan Yew, and his colleagues and successors understood is that the combination of single-party rule and corruption is toxic. If you want the benefits of the former, you cannot allow the latter.

Coherence, long time horizons, appropriate incentives, strong “navigational” skills, and decisiveness are desirable aspects of continuity in governance, especially in a meritocratic system managing complex structural shifts. To protect that and maintain public support for the investments and policies that sustain growth, Singapore needed to prevent corruption from gaining a foothold, and to establish consistency in the application of rules. Lee did that, with the PAP supplying what a full formal system of public accountability would have provided..."

at http://www.project-syndicate.org/commentary/reforming-one-party-rule-in-china-by-michael-spence#uHaavWr8RITt3OVx.99

Central Banks’ Gold Likely Gone-Eric Sprott

"Money manager Eric Sprott says, “The central banks’ gold is likely gone with no realistic chance of getting it back.” Don’t expect this revelation to get any coverage by the mainstream media. In an interview last week, Sprott’s analysis was met with words such as “gold bug” and “conspiracy theory.” Sprott answers that sort of disrespect by saying, “We’ve had so many conspiracies, I don’t know why anyone would think this was unusual.” To back up his point, he named “LIBOR, electricity markets in California and the Madoff” scandals. Sprott’s analysis shows a “flat supply” and at least a “2,500 ton net increase in gold demand” since 2000. “Where’s all the gold coming from?” asks Sprott. He says Western central banks “. . . keep supplying this market with product in order to keep the price down so nobody knows how vulnerable the situation is.” Sprott, who manages nearly $10 billion in assets, boldly proclaims, “We have a shortage of gold.” Join Greg Hunter as he goes One-on-One with Eric Sprott of Sprott Asset Management..."

at http://usawatchdog.com/central-banks-gold-likely-gone-eric-sprott/

at http://usawatchdog.com/central-banks-gold-likely-gone-eric-sprott/

Art Cashin - Prepare For Currency Wars & Ground Wars

"...Cashin also cautioned, “What

troubles me in that area is the call for elections in Japan, and the fact that

Mr. Abe, who had been Prime Minister, may come back. He has called for

unlimited monetary easing from the Bank of Japan and the Ministry of

Finance.

It sounds to me like we are on the verge of a major

currency war, under the guise of monetary policy. He specifically said, ‘I want

to see the rate of inflation go above 3%.’ Now I’m sure they are bright enough

not to get into something like Germany in the Weimar Republic. But we’ve got

central banks all around the world beginning to play with fire.”

We Are Speeding Towards Economic & Social Devastation

"...In late 1789, France was heavily in debt and running

a substantial annual deficit. The minister of finance at the time was a man

named Necker. Necker was described as a man of “sterling honesty, who gave up

health and fortune for the sake of France”. Before he left France forever,

Necker was called “a wretch seeking only to enrich himself from the public

purse”. So much for gratitude. He stood in the way of the “necessity” of

borrowing money.

A new and improved version of fiat money creation

called for the issuance of what were termed “assignats”. These were notes

secured by the real estate recently confiscated from the Catholic Church. In

addition, the notes carried an interest rate of 3%. To make them even more

believable, they were beautifully engraved with a portrait of King Louis XVI.

It was said that the issuance of the assignats would do amazing things such as

stimulate business, give everyone buying power and that the debts of the nation

could be repaid.

It was also specified that no more than 400 million

would be printed. If they had lived up to the promise not to exceed 400

million, some of the positive outcomes might have come true. They did not. In

the end, 26 billion were printed, as well as a new version called “mandats”.

The “mandats” were said to be “good as gold”. In the end, both the assignats

and the “mandats” were worthless.

This new fiat money scheme did not end well. The

best job in France was probably working at the print shop cranking out billions

of new paper money. While there was an initial boost to business and exports in

general, it soon ran out of gas and France’s manufacturers shuttered their

plants and massive unemployment ensued.

The country was flooded with paper currency. The

value of the currency dropped precipitously. In an amazing display of ignorance

and propaganda, the government attributed the declining value of the currency to

a failure to print more paper money. Desperate people will say and do desperate

things. Many forms of outright tyranny ensued. One of the manifestations of

this tyranny was a policy of “Forced Loans” to the government inflicted upon

those who still had any remaining wealth.

What makes this episode in monetary history so

critically important to us today was not that the French in fact did this. The

first important lesson for us was the speed with which it went from issuance to

complete economic and social devastation. This was not a long drawn out

affair.

The second lesson comes from not only listening to

the assurances of those who set this tragedy in motion, but the assurances and

explanations along the way. History says that once set in motion, fiat money

schemes cannot be reversed. Tragedy and collapse are the terminal destinations

for this “train”. So just 70 years later, the French went down the same path

that was so disastrous for their ancestors.

The world is now repeating the same process, despite

the knowledge of so many failed and tragic dalliances with currency depreciation

in the past. One almost gets the sense that this oft-repeated story is simply

part of the cycle of human existence."

Embry - $67 Trillion Shadow Banking System & $10,000 Gold

"...So Keith

Barron is correct because the problem is twofold: Existing production is

going to go down a lot. So for the major mining companies, to achieve growth,

not only are they going to have to replace existing production, which will fall

significantly, but they will have to replace that plus even more

development.

The problem is that with the current gold price and

what has taken place in the share environment, I don’t see any possibility of

that taking place. One of the great pieces of misinformation that has been

spread by the agents of the people suppressing the price of gold, is that at

these higher gold prices we would experience a boom in gold mining. Nothing

could be further from the truth.”

Embry also added: “If you

stop to think about it, Eric, the fact that the gold price is currently $170

lower at the end of August of one year ago, given what has gone on with respect

to QEs, wars, and financial implosions, it’s preposterous that the gold price is

where it is.

But it shows the power of paper, and that’s the

reason we have all of these derivatives because you can control markets quite

effectively, until you can’t. At that point the price of gold is going to go

crazy. Thing about the fact that the shadow banking system is $67 trillion, and

the leverage that creates in the system. I just think that the ‘end’ of this is

going to be horrific.”

Thursday, November 15, 2012

The System Will Collapse, It Must Collapse-Chris Duane

"Chris Duane of TheGreatestTruthNeverTold.com says Hurricane Sandy should be a wakeup call for the entire country. Duane says, “The impact of a dollar collapse will be hundreds, if not thousands, of times more disruptive to life than a two day storm.” Duane goes on to say, “Sandy is a great precursor to help you get your act in gear.” According to Duane, most people are just as unprepared for a dollar calamity as they were for the recent super storm in the Northeast. A much bigger financial storm is coming. “The big problem with all this is counter-party risk. You cannot trust anybody; you can’t even trust the currency.” Duane trusts physical silver, and he thinks its 53 to 1 silver to gold ratio per ounce makes silver attractive. Duane thinks he could make a good case for “. . . a one-to-one silver to gold ratio, especially with all the paper manipulation.” Duane says, “The system will collapse, it must collapse, and people will learn a very difficult lesson.” In the next move up, Duane see’s silver “pushing past $50 per ounce.” Join Greg Hunter as he goes One-on-One with Chris Duane of TheGreatestTruthNeverTold.com. His YouTube channel has more than 5 million views in a little more than a year."

at http://usawatchdog.com/the-system-will-collapse-it-must-collapse-chris-duane/

at http://usawatchdog.com/the-system-will-collapse-it-must-collapse-chris-duane/

Roubini : Eurozone Crisis Spreading From Periphery to Core

"Nouriel Roubini : “The economic contraction used to be in the periphery of the euro zone,” “It is spreading now to the core of the euro zone. For example, it is quite clear that France is entering a recession.” Roubini said in a speech in Mainz, Germany, today. - in bloomberg"

at http://nourielroubini.blogspot.com/2012/11/roubini-eurozone-crisis-spreading-from.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+NourielRoubiniBlog+%28Nouriel+Roubini+Blog%29

at http://nourielroubini.blogspot.com/2012/11/roubini-eurozone-crisis-spreading-from.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+NourielRoubiniBlog+%28Nouriel+Roubini+Blog%29

Monday, November 12, 2012

Jim Rogers: Market turmoil ahead

"Jim Rogers : "I would be very careful. The next couple years we're going to have turmoil and problems in most financial markets," Rogers told CNN's Andrew Stevens. "Don't invest in anything unless you, yourself know about it. Don't listen to some guy you see on TV -- even if it's me," added Rogers, who co-founded the Quantum Fund with George Soros. "You only stay with what you know and if all you know is money in the bank, put the money in the bank."

at http://jimrogers1.blogspot.com/2012/11/jim-rogers-market-turmoil-ahead.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

at http://jimrogers1.blogspot.com/2012/11/jim-rogers-market-turmoil-ahead.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FWOHK+%28Jim+Rogers+Blog%29

Embry: China To Import A Staggering 775 Tons of Gold In 2012

"Today

John Embry spoke with King World News about the staggering pace of Chinese gold

imports, Western central bank dishoarding of gold, the imploding global economy,

which country will hyperinflate first, and mining shares.

Here is what Embry, who is chief investment strategist at Sprott Asset

Management, had to say: “I’m very encouraged by the continued flow of the world’s gold

into China through Hong Kong. The Chinese were essentially accumulating their

gold by purchasing all of their domestic production, and now they are the

largest domestic producer in the world.”

John Embry

continues:

“But now they are buying the world’s gold at an

ever-increasing rate. At this point, based on the imports through the first

nine months of the year, if you pro-rated for the last three months, they would

for the full year have imported a staggering 775 tons of gold.

Well, if you take that as a percentage of the

non-Chinese production, that’s about 1/3 of the non-Chinese mine production

that’s going into China. This wasn’t happening two years ago. So my question

is, where is the gold coming from?...."

Thursday, November 8, 2012

Richard Russell - I See Catastrophic Insane Bubbles Everywhere

"Today

the Godfather of newsletter writers, Richard

Russell, has written a very serious piece discussing the fact that we are seeing

insane bubbles in many different areas. But Russell also covers the state of

the gold market and what investors should be doing with their gold.

Here are Russell’s thoughts in his latest note to

subscribers: “What's Bernanke doing for the dollar -

or to the dollar? By creating multi-millions of additional dollars, the

Bernanke Fed has knocked the dollar down. But due to weakness in other major

currencies, the dollar (which is now oversold) has rallied over the last day or

so.”

Marc Faber : The U.S. will Default through a Depreciating Currency

"TGR: You've discussed investors leaving the European markets in favor of a "safe haven" in the U.S. Would U.S. bonds continue with such low yields with the European downgrades?

Marc Faber : For a while, yes, but at some point people will wake up and realize that the U.S. will default through a depreciating currency—in other words, through printing money—or by not paying the interest on the bonds. I don't think the U.S. will stop paying the interest, but printing more money will weaken the currency and produce higher inflation in consumer prices, asset prices and commodity prices. So being in U.S. government bonds will result in losses to investors through currency depreciation. - in a recent interview with in The theaureport"

Marc Faber : For a while, yes, but at some point people will wake up and realize that the U.S. will default through a depreciating currency—in other words, through printing money—or by not paying the interest on the bonds. I don't think the U.S. will stop paying the interest, but printing more money will weaken the currency and produce higher inflation in consumer prices, asset prices and commodity prices. So being in U.S. government bonds will result in losses to investors through currency depreciation. - in a recent interview with in The theaureport"

What You Need To Know About The Coming Gold & Silver Move

“My advice is if we get a dip in gold, I would buy

that dip. Gold has a lot of support. I think long-term and that’s a bet that

I’m always willing to make. I haven’t sold a single ounce of gold or a single

share of a gold stock. That is because I am positioning and I am thinking about

the long-term.

I am going to tell you what reassures me....

“China is what reassures me. Data came out of China

on Monday that their gold purchases increased by a huge percentage from August

to September. China, year-over-year, has increased their purchases of gold by a

staggering three-fold.

China is in this to make sure they have something

tangible they can trade for commodities, which they know they are going to need

at some point in the future. People talk about China and say it is overbuilt,

but that’s not entirely true. If you look on a per capita basis, China has 1/15

as many railways as the US has.

Why is that important? Because railways are a way of

saving energy and a way of transporting commodities from coast to coast, across

the country. Why did Warren Buffett make his biggest investment into Burlington

Northern? He gets it and it’s all about commodities and transportation. This

is about building out infrastructure.

China wants gold so they can continue with their

plans. They want their currency backed up in gold and they are going to

continue to buy it. So gold may weaken, but if it does people should buy it.

Once gold starts taking out the all-important $1,800 level, you are not going to

have a chance to get into the market. It will not let you in..."

Monday, November 5, 2012

Marc Faber : we will have a Systemic Crisis and Everything will Collapse

"Marc Faber : Over the next five years or so, we will witness slow growth or no-growth in Europe, coupled with continuing drop in the standard of living, both in the US and Europe.

This will require money pumping or printing of money to support economies. However, a large part of this will flow into assets and erode cost of living.

So, in the interim, we will have assets prices moving up, but I would say in the long term, we will have far better opportunities compared to today.

But I believe eventually we will have a systemic crisis and everything will collapse. That I think will provide better opportunity to invest. - in Business Standard"

at http://marcfaberchannel.blogspot.com/2012/11/marc-faber-systemic-crisis-and.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

This will require money pumping or printing of money to support economies. However, a large part of this will flow into assets and erode cost of living.

So, in the interim, we will have assets prices moving up, but I would say in the long term, we will have far better opportunities compared to today.

But I believe eventually we will have a systemic crisis and everything will collapse. That I think will provide better opportunity to invest. - in Business Standard"

at http://marcfaberchannel.blogspot.com/2012/11/marc-faber-systemic-crisis-and.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MarcFaberBlog+%28Marc+Faber+Blog%29

We’re Witnessing Shocking Surge Of Retail Gold & Silver Buying

"Today

one of largest gold and silver dealers in the United States told King World

News, “We had massive retail buying of gold and silver this week. I would also

add the buyers have come flooding in for the past two weeks, but there was

literally an enormous surge of buying which took place on the gold and silver

takedown on Friday.”

Here is

the balance of what 40-year veteran, Bill Haynes, President of CMI Gold

& Silver had to say: “This

massive buying came in from many people who are brand new to the gold and silver

markets. But at the same time, investors which own physical gold and silver at

much lower prices were stepping up and adding aggressively to their existing

positions.

Across the board, buyers expressed that they were

deeply troubled about the deteriorating financial condition of the United States

and other Western nations...."

Friday, November 2, 2012

The peripheral threat to France

"Compétitivité is a big deal in France right now.

The country’s loss of competitiveness is a serious issue, especially as its crisis-struck neighbours push on with wage cuts and labour reform.

On Monday, Louis Gallois, former head of EADS, is going to publish his report on the issue, and he’s expected to call for a “competitiveness shock”. He’s already said that he wants to see somewhere between €30bn-€50bn of taxes from the payrolls transferred to broader-based taxes, such as VAT, much to the delight of business leaders.

Reform really can’t come soon or fast enough. As The Economist writes (our emphasis):

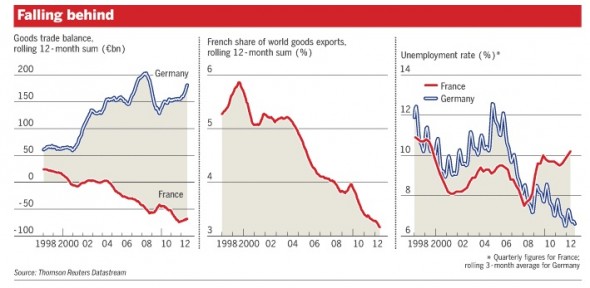

If you’re unconvinced, here’s French economic decline and German strength in chart form:

But Francois Hollande’s government has only gone as far as call for a competitiveness “pact” (to be implemented over a five-year period). It hardly suggests urgency. And this already-too-weak message is much undermined by his 2013 budget, which, proposes to raise €20bn more in tax (half of which would come from the corporate sector), while reducing public spending by just €10bn. Unsurprisingly, businesses see it as a deterrent to job creation and investment..."

at http://ftalphaville.ft.com/2012/11/02/1243881/the-peripheral-threat-to-france/

The country’s loss of competitiveness is a serious issue, especially as its crisis-struck neighbours push on with wage cuts and labour reform.

On Monday, Louis Gallois, former head of EADS, is going to publish his report on the issue, and he’s expected to call for a “competitiveness shock”. He’s already said that he wants to see somewhere between €30bn-€50bn of taxes from the payrolls transferred to broader-based taxes, such as VAT, much to the delight of business leaders.

Reform really can’t come soon or fast enough. As The Economist writes (our emphasis):

Over the past 12 years, France has steadily lost competitiveness to Germany, its fellow euro-zone giant. A recent competitiveness study by the World Economic Forum ranked Germany sixth, and France 21st. Labour costs have risen far faster than in Germany. French public spending, at 56% of GDP, is ten percentage points higher than in Germany. France’s share of extra-EU exports has dropped and the trade deficit has reached €70 billion. The Netherlands, with a fraction of its population, now exports more than France.Last year, the welfare taxes levied at French employers were among the highest in the eurozone at €50.3 for every €100 paid to an employee versus €28 in Germany, according to Medef, the French employers’ lobby.