To Austrians, meanwhile, the Depression demonstrated that 1) the best way to prevent a bust is to avoid the preceding boom, which is another way of saying that the size and composition of the national balance sheet is the key to everything, and 2) the best way to get through a bust is to let market forces liquidate the bad debt as quickly as possible.

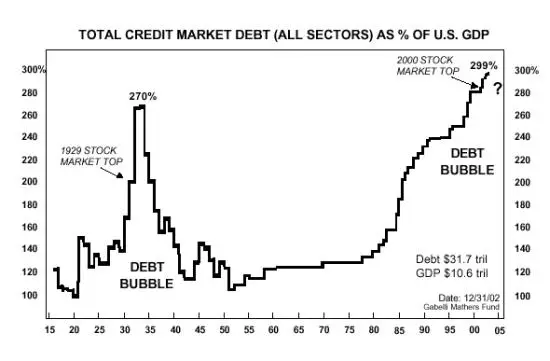

A September 14 DollarCollapse column took the Austrians’ side in the debate and illustrated the point with the following chart, which depicts the massive deleveraging of the 1930s..."

at http://dollarcollapse.com/credit-bubble-2/what-the-great-depression-and-world-war-ii-really-teach-us/

No comments:

Post a Comment