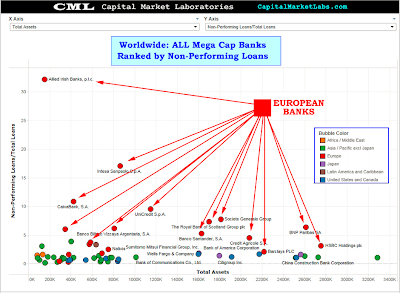

Let's start with a visualization of the day: Worldwide Mega Cap Banks: Is Europe in Crisis?

If we take all of the banks in the world with market caps larger than $25 billion USD and then plot them with total assets on the x-axis and non-performing loans as a percentage of total loans, ALL of the top eleven are in Europe.Click on any chart in this post for a sharper image.

Severe European Bank Crisis

Ophir Gottlieb expanded on the European bank crisis idea in this guest MarketWatch post yesterday: Opinion: European banks are Stuck in a Severe Crisis.

Big banks in Europe are riskier than anywhere else in the world.

They have higher non-performing loans, greater asset shrinkage, larger losses and higher debt-to-equity ratios. And European banks are bracing for even worse loan losses.

It’s the combination of those characteristics that lead to a crisis, and the eurozone essentially is in one today.

Non-performing loans over total loans

There are 200 banks in the world with market values of more than $5 billion, 48 of which are in Europe. The chart below plots non-performing loans over total loans on the y-axis and market capitalization (or value) on the x-axis for that population of banks.

If we take the population of world banks greater than $5 billion in market capitalization and select those with non-performing loans over total loans that are greater than 5% (worse than the Bank of America/Countrywide/Merrill Lynch combination), we are left with 24 banks. Twenty-one of those are in Europe.

at http://globaleconomicanalysis.blogspot.com/2014/12/charts-show-28-seriously-troubled-mega.html#6qF6Wyzfx8pKrdME.99

No comments:

Post a Comment