at http://jimrogers1.blogspot.com.tr/2014/07/jim-rogers-to-bulliondesk-gold-to-go.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+blogspot/WOHK+(Jim+Rogers+Blog)

Links to global economy, financial markets and international politics analyses

Wednesday, July 23, 2014

Jim Rogers to Bulliondesk – Gold ‘to go much higher

"Jim Rogers : “Commodities will end in a bubble by the end of

the bull market, whenever that is – whether that is in two years’ time or five

years’ time,” the author and hedge fund manager said. “Bull markets normally

end in a bubble and this one may be no different.” “I still own gold – though

I’m not buying at the moment. But if there is another buying opportunity in the

next year or two, I will buy because it will go much, much higher. Gold will be

one of the final commodities to end in a bubble in this cycle.” - via

Bulliondesk"

at http://jimrogers1.blogspot.com.tr/2014/07/jim-rogers-to-bulliondesk-gold-to-go.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+blogspot/WOHK+(Jim+Rogers+Blog)

at http://jimrogers1.blogspot.com.tr/2014/07/jim-rogers-to-bulliondesk-gold-to-go.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+blogspot/WOHK+(Jim+Rogers+Blog)

Monday, July 21, 2014

Historic Default Looms, Gold And Silver Surge & 3 Key Charts

"The charts below show the level of consumer loans for all commercial banks. The 2008-9 debacle had a much bigger impact upon consumers and the level of outstanding debt was dramatically reduced. You can also see that the charge-off rate for the banks subsequently plunged. Despite that good news, it also looks like the consumer is once again ramping up that expensive, short-term debt. If history can be our guide, the charge-off rate will soar once again.

The Federal government, however, barely skipped a beat. It looked like the strong economy of the late 1990s was going to result in a dramatic reduction of the Federal debt, perhaps even the elimination of the debt that caused so much angst for the then-chairman of the Fed, Alan Greenspan.

Not to worry, though. Starting in 2000 the federal debt went on a tear to the upside and has never looked back. The chart below shows, as a percentage of GDP, it now stands above the magic level of 100 percent of GDP, and that is not reflective of the off-book accrued liabilities in the $100 trillion range.

It is no accident that budgets have been abandoned as a concept. The consumer uses debt to continue spending at unrealistic levels, trimming when forced to do so by recessions through repayment or default. The federal government has also effectively abandoned the budgeting process, and there seems to be no serious effort to reintroduce it back into the system. We can’t say we blame the politicians and central planners. There is no solution and the problem is systemic through the world.

For the moment, the federal printing press remains the magic credit card of the ages. We say “for the moment” as history is very clear about the mortality of the reserve currencies of the past. It is not forever, even though the markets act as if it were without end. History is also very clear that crossing the 100 percent of GDP level of debt marks a line from which there is no return. Default is the only remaining conclusion. When, who knows? Will it occur? It has for every country that has walked this path without exception.

In the public markets, there remain three categories of opportunity for investors.

The first would be companies that benefit from the largesse of government programs.

The second are businesses that are creating new markets or solving old problems.

The last is in the resource sector, precious metals, miners, and suppliers of energy. For the first time, last week we began to hear gold being mentioned as a “safe-haven” play by the mainstream media. Up until recently cash and fixed income were the “go to” sectors for reducing risk. With current and former Fed officials warning about the coming rise in rates and encouraging investors to sell bonds, it was a little-noticed but very significant change in the media. With an extremely tight and getting tighter supply/demand situation for the metals, we could very well be on the edge of a dramatic revaluation to the upside for the precious metals as those assets are viewed for the safe-haven qualities that have persevered throughout human history..."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/21_Historic_Default_Looms,_Gold_And_Silver_Surge_%26_3_Key_Charts.html

Friday, July 18, 2014

Why One Big Bank Is "Worried That The Market Is Stretched And Could Correct Rapidly"

"Aside from a relentless barrage of deteriorating geopolitical updates almost on a daily basis, which have led even the "very serious thinkers" to pull up comparisons to the days just before World War I, it has been smooth sailing for global capital "markets" which merely continue to follow the path of least central bank balance sheet resistance. It is this relentless melt up which has seen what was once a market and is has for the past 5 years become a policy vehicle to boost confidence (for whom, it is unclear: the vast majority of the population no longer cares what rigged stocks do, as for the trickle down wealth effect, 5 years of deteriorating real incomes for the middle class have promptly put an end to that fable) alongside a slow-motion LBO of the entire S&P 500, as companies repurchase trillions of their shares using ultra-cheap credit, bask in the glow of complacency so vast even the Fed is openly warning against it.

It is in this context that at least one bank, has voiced an alarm against pervasive, record complacency (that no matter how bad things get, the Fed will step in a bail everyone out, in fact the worse things get the better) after UBS' Stephane Deo released a paper titled "We are worried. We reduce risk - for now."

The key excerpts from the report:

Firstly we are concerned about valuations. We show that equity markets are stretched (e.g., more than 80% of the S&P rally since last year is due to re-rating), but we also find that the fixed income market has become quite rich (we have been overweight European peripherals for more than a year on valuation grounds, we show that this argument no longer holds), and the same is true of the credit market. Second because capital has been flowing rapidly into risky assets, we document that argument and here too find evidence that the market might be ahead of itself. We read the market reaction last week to the Portuguese news as a sign that the market is indeed too complacent and could correct rapidly.

Why we are worried

As we wrote in the previous section we remain constructive on risky assets over the medium term. However we think it is now time to scale down risk. The canary in the coalmine this time was Portuguese: The issue last week with Banco Espírito Santo (BES) had large impact on a variety of asset classes over the world. This includes other Portuguese banks, but also wider range of asset like the all SX7E index, the sovereign spreads in Europe and it even had an impact on the VIX. The various reactions from these asset classes seem large unless the BES event hides something much bigger and is the start of a new systemic crisis. This is not our central case scenario. In a recent note Bosco Ojeda explains that genuine improvements have been accomplished in peripheral Europe and the return of systemic risk is unlikely. Rather we think the event tells us a story about market positioning and market pricing: we think the market is stretched (more on that immediately below). If this is true, the market is already pricing most of the potential good news and is prone to react to bad news.

The pricing argument

Let's first look at pricing. We have argued that all the major stock markets are close to fair value. This is the case if we look for e.g. at our trend adjusted P/E, or if we look at our equity risk premium index. What is true though is that the recent momentum in markets is difficult to justify. The chart below shows that our economic surprise index has been very highly correlated with the S&P 500 until the beginning of last year. Since then the market has continued his rally with little fundamental improvement to support it. This divergence is becoming uncomfortably large.

And indeed, as we go to press, we get a helping hand from the Fed himself. The Fed said in a report that “valuation metrics in some sectors do appear substantially stretched, particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year.”

at http://www.zerohedge.com/news/2014-07-18/why-one-big-bank-worried-market-stretched-and-could-correct-rapidly

US Treasury Admits Collateral Problem In Bond Market; Considers Issuing Ultra Long-Dated Bonds

"We noted yesterday once again that The Fed was out en masse demanding investors sell their bonds because "bonds are in a bubble" but not stocks. The reason - as we have explained in great detail - is the repo market is broken due to massive collateral shortages (thanks to the Fed). Today, the Fed admitted it has a problem...

- *TREASURY ASKS DEALERS TO EXPLAIN REASONS FOR FAILS-TO-DELIVER

The tongue in cheek message of course is that the Treasury wants to know why all the dealers continue to be so short bonds (even as it urges 'investors' to sell). Furthermore, it is surveying dealers over the need to issue bonds of greater maturity than 30 years in order to fulfill collateral needs.

Via Bloomberg

The U.S. Treasury Department is asking bond dealers whether it should consider issuing a security with a maturity exceeding 30 years.“Please comment on the demand for long-duration sovereign products,” the department said in a quarterly survey of dealers released today in Washington. “Should Treasury consider issuing a security with a maturity greater than 30 years?”The Treasury also asked the dealers to explain the causes for an increase recently in “fails-to-deliver” in the market for U.S. government debt. The survey was released ahead of meetings planned for July 31-Aug. 1.

* * *

But why do I care about some archaic money-market malarkey? Simple, Without collateral to fund repo, there is no repo; without repo, there is no leveraged positioning in financial markets; without leverage and the constant hypothecation there is nothing to maintain the stock market's exuberance (as we are already seeing in JPY and bonds).

Crucially, it should be inherently obvious to everyone that the moves we see in the stock market is not about mom and pop choosing to invest in the stock market (or not) as the 'cash on the slidelines' fallacy is "completely idiotic' but about the marginal leveraged machine (or human) quickly jumping oin momentum.

The spike in "fails to deliver" highlights a major growing problem in the repo markets that provide that leverage... and thus the glue that holds stock markets together..."

at http://www.zerohedge.com/news/2014-07-18/us-treasury-admits-collateral-problem-bond-market-considers-issuing-ultra-long-dated

Exchange Controls And Perfect Fake Gold & Silver Coins

"Today a 42-year market veteran warned King World News that perfect fake gold and silver coins will proliferate the market and the prices of gold and silver rise. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview.

Greyerz: “Eric, the U.S. dollar hegemony and role as a reserve currency is soon going to come to an end. This will lead to a precipitous fall of the dollar. The further consequences will be severe U.S. exchange controls. It will be virtually impossible for private individuals to transfer any funds out of the United States....

Greyerz: “Eric, the U.S. dollar hegemony and role as a reserve currency is soon going to come to an end. This will lead to a precipitous fall of the dollar. The further consequences will be severe U.S. exchange controls. It will be virtually impossible for private individuals to transfer any funds out of the United States....

“It won’t matter if the transfer is for investment purposes or for holiday use. The fall of the dollar will also lead to major pressures in the U.S. economy and the U.S. financial system. So the U.S. will experience bail-ins and the U.S. will see forced transfer of savings into Treasuries as the budget deficit escalates to a much higher level.

Also, interest rates will rise dramatically since no one will lend money at zero rates to an economy with a weak currency and debt that can’t be repaid. Eventually rates will go to at least 15 percent to 20 percent, like we saw in the 1970s. All of that will be the start of the hyperinflationary depression that will hit the U.S. and major parts of the world.

In a world with total debt of $280 trillion, and total unfunded liabilities totaling many hundreds of trillions of dollars, plus derivatives of over one quadrillion dollars, this unprecedented global debt can never be repaid out of proper revenue growth. The die was cast in 1913 when the Fed was created, and recast in 1971 when gold no longer backed up any currency.

After the removal of gold from the system there was a free-for-all for governments and central banks to borrow and print unlimited amounts of money. If more people believed that the excellent KWN contributors were right, there would be far more than 1 percent of world assets invested in gold. A lot more people would realize that wealth preservation and insurance in the form of physical gold is critical.

But as gold goes to $5,000, $10,000, and eventually much higher, the whole world will want to own gold. As always, it’s important not to wait for the herd, but to take action now. When we recommended up to 50 percent of assets be put into physical gold in 2002, gold was trading at $300 and it was unloved and undervalued. That is the time to invest.

Today, 12 years later, at $1,300 per ounce gold is still unloved and undervalued. It’s unloved because virtually nobody owns gold. And gold is greatly undervalued because at $1,300, which is the marginal production cost, it does not reflect the massive credit creation and money printing that has taken place since 2008 crisis.

During that crisis the financial system almost collapsed. But the day of reckoning was deferred by governments and central banks throwing $25 trillion at the problem, and reducing short term interest rates in the U.S. from 5 percent to zero percent. But the same problems are still there in the financial system and in the economy. The difference now is that borrowings, both governments and private, are exponentially higher as interest rates have been artificially set at zero.

The problem is that credit and printed money no longer have any effect. Thus when the 2008 problems reemerge with a vengeance, there are absolutely no effective measures that governments can take. So if governments can’t do anything, what can investors and savers do? Well, I and many of the lone voices on KWN have for a long time advised people to get out of the banks and also get out of the weak currencies like the dollar, the euro, the yen, and most others.

Physical gold and silver should be held outside of the banking system. That will be the best form of wealth preservation and insurance. Some gold should be held in small denominations like 100 gram bars and 1 ounce coins. I don’t think it’s worthwhile holding smaller coins and bars than that. This is because I don’t see gold being used for daily purchases of goods and services..."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/17_Exchange_Controls_And_Perfect_Fake_Gold_%26_Silver_Coins.html

Wednesday, July 16, 2014

BRICS Launc $100 Billion Development Bank and Currency Reserve Pool

"And so it begins.

at http://jessescrossroadscafe.blogspot.com.tr/2014/07/brics-launc-100-billion-development.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+JessesCafeAmericain+(Jesse%27s+Caf%C3%A9+Am%C3%A9ricain)

The big changes happen slowly.

I expect the BRICS to continue 'tinkering' with the meaning of reserve currency in the global financial system.

I expect the BRICS to continue 'tinkering' with the meaning of reserve currency in the global financial system.

BRICS set up Bank to Counter Western hold on Global FinancesBy Alonso Soto and Anthony BoadleFORTALEZA BrazilWed Jul 16, 2014 2:56am IST(Reuters) - Leaders of the BRICS emerging market nations launched a $100-billion development bank and a currency reserve pool on Tuesday intheir first concrete step toward reshaping the Western-dominated international financial system.The bank aimed at funding infrastructure projects in developing nations will be based in Shanghai and India will preside over its operations for the first five years, followed by Brazil and then Russia, leaders of the five-nation group announced at a summit.They also set up a $100 billion currency reserves pool to help countries forestall short-term liquidity pressures.The long-awaited bank is the first major achievement of the BRICS countries since they got together in 2009 to press for a bigger say in the global financial order created by Western powers after World War II.The BRICS were prompted to seek coordinated action following an exodus of capital from emerging markets last year, triggered by the scaling back of U.S. monetary stimulus. The new bank reflects the growing influence of the BRICS, which account for almost half the world's population and about one fifth of global economic output. The bank will start with a subscribed capital of $50 billion divided equally between its five founders, with an initial total of $10 billion in cash put in over seven years and $40 billion in guarantees.The bank will start lending in 2016 and be open to membership by other countries, but the capital share of the BRICS cannot drop below 55 percent. The contingency currency pool will be held in the reserves of each BRICS country and can be shifted to another member to cushion balance of payments difficulties. This initiative gathered momentum after the reverse in the flows of cheap dollars that fueled a boom in emerging markets for a decade. "It will help contain the volatility faced by diverse economies as a result of the tapering of the United States' policy of monetary expansion," President Dilma Rousseff said.China, holder of the world's largest foreign exchange reserves, will contribute the bulk of the contingency currency pool, or $41 billion. Brazil, India and Russia will chip in $18 billion each and South Africa $5 billion. If a need arises, China will be eligible to ask for half of its contribution, South Africa for double and the remaining countries the amount they put in. Negotiations over the headquarters and first presidency were reached at the eleventh hour due to differences between India and China. The impasse reflected the difficulties that Brazil, Russia, India, China and South Africa face in working together to build an alternative to the Bretton Woods institutions dominated by the International Monetary Fund and the World Bank."We pulled it off 10 minutes before the end of the game. We reached a balanced package that is satisfactory to all," a Brazilian diplomat told Reuters.Negotiations to create the bank dragged on for more than two years as Brazil and India fought China's attempts to get a bigger share in the lender than the others.Stark economic and political differences between the BRICS countries have made it difficult for the group to turn rhetoric into concrete action in coordinating policies..."

at http://jessescrossroadscafe.blogspot.com.tr/2014/07/brics-launc-100-billion-development.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+JessesCafeAmericain+(Jesse%27s+Caf%C3%A9+Am%C3%A9ricain)

JIM ROGERS -- BRICS Making Plans To Compete AGAINST the U.S. DOLLAR

"A new Gold Standard is coming, led by the East, driven

through trade. The BRICS nations have decided to fund their development bank

with $100 billion. The reserves are aimed at financing joint development

ventures, and are set to rival the dominance of the World Bank and the IMF.

at http://jimrogers1.blogspot.com.tr/2014/07/jim-rogers-brics-making-plans-to.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+blogspot/WOHK+(Jim+Rogers+Blog)

"At the final stage of realization -- the initiative to

create a BRICS forex reserve pool -- the size of its capital has been agreed at

$100 billion," Russian President Vladimir Putin said while opening the G20

Summit in St. Petersburg.

Russia, Brazil and India will contribute $18 billion to the

BRICS currency reserve pool, while China $41 billion and South Africa $5

billion, according to a press release issued by the BRICS on Thursday. Earlier

this week Russia's Finance Minister Sergei Storchak said that there were still

a lot of "difficult details" to sort out.

"These are systematic themes, complicated [and]

negotiationsare difficult. We must assume the bank will not start functioning

as fast as one could imagine. It will take months, maybe a year,"

The creation of the reserves pool may help the BRICS nations

in their drive to reform votes and quotas in the International Monetary Fund

(IMF).

The Almighty Dollar Is In Peril As The Global

'De-Dollarization' Trend Accelerates

Prominent international voices are starting to question why

the U.S. dollar should be so overwhelmingly dominant. As the Obama

administration continues to alienate almost everyone else around the entire

planet, an increasing number of prominent international voices are starting to

question why the U.S. dollar should be so overwhelmingly dominant in global

trade. In previous articles, I have discussed Russia's "de-dollarization

strategy" and the fact that Gazprom is now asking their large customers to

start paying in currencies other than the dollar. But this is not just a story

about Russia any longer. China and South Korea have just signed a major

agreement to facilitate trade with one another using their own national

currencies, and even prominent French officials use the dollar less and the

euro more. John Williams of shadowstats.com recently said that things have

never "been more negative" for the U.S. dollar, and he was right on

the mark. The power of the almighty dollar has allowed all of us living in the

United the U.S. economy. In future years the value of the dollar will go down

substantially, all of the imported goods filling our stores will become much

more expensive, and it is going to cost the federal government a lot more to

borrow money. Unfortunately, with the stock market hitting all-time record

highs and with the mainstream media endlessly touting an "economic

recovery", most Americans are not paying any attention to these things.

French oil giant Total is one of the largest energy

companies in the entire world. On Saturday, Total's CEO made an absolutely

stunning statement. According to Reuters, he told reporters that there "is

no reason to pay for oil in dollars"...

The BRICs Are Morphing Into An Anti-Dollar Alliance

increasingly more countries are setting the stage for the

final currency war, we go again to Russia where VOR's Valentin Mândr??escu

explains that slowly but surely the BRICS -- that proud Goldman acronym which

was conceived to perpetuate the great American way of life by releasing

trillions in US-denominated debt in heretofore untapped markets -- are morphing

into an anti-dollar alliance.

BRICS is morphing into an anti-dollar alliance, From VOR

Before the crucial visit to Beijing next week, the governor

of the Russian Central Bank, Elvira Nabiullina met Vladimir Putin to report on

the progress of the upcoming ruble-yuan swap deal with the People's Bank of

China and Kremlin used the meeting to let the world know about the technical

details of its international anti-dollar alliance."

Billionaire Sprott - The Bank Of England Gold Vaults Are Empty

"As the gold and silver smash continues for a second day, billionaire Eric Sprott warned King World News that the Bank of England gold vaults are empty and there will be a price to pay for what Western central planners have done. The Canadian billionaire also warned about the banking system. Below is what Sprott, Chairman of Sprott Asset Management, had to say in Part I of a remarkable series of interviews that will be released today.

Sprott: “We have the Chinese coming in and buying an extra 1,500 tons (of gold). We will have a GLD metric that could be as much as 1,000 tons just this year, year over year. The Indians haven’t changed the laws yet but I think that will be forthcoming, and they can get back into normal buying mode....

Sprott: “We have the Chinese coming in and buying an extra 1,500 tons (of gold). We will have a GLD metric that could be as much as 1,000 tons just this year, year over year. The Indians haven’t changed the laws yet but I think that will be forthcoming, and they can get back into normal buying mode....

“We know that production is likely to fall off because of the lack of financing, the difficulty of getting projects approved, the unwillingness to go into projects, and the massive decline in exploration.

So if you look at it from a longer-term perspective, you can see that all the catalysts are in place. In terms of the immediacy of something, it’s going to be a failure to deliver. I don’t know where it’s going to occur, but it will be a failure to deliver somewhere.”

Eric King: “It almost sounds like you feel that failure to deliver is imminent.”

Sprott: “It’s hard for me not to think it’s imminent. When I got into the gold market back in 2000 I read Frank Veneroso’s gold book. He suggested that the central banks, who said they had 35,000 tons of gold, probably only had 18,000 tons.

And I see data every year that suggests demand might exceed supply by 2,000 tons. So the metal can come from only one place -- (Western) central banks. That’s why I wrote the article in 2012, ‘Do They Have Any Gold Left?’ Then you see data points out of the U.S., where the U.S. is exporting 40 tons of gold one month, and the U.K. is exporting 112 tons to Switzerland one month, and the U.K. doesn’t even produce any gold -- so where is this gold coming from?

These numbers all reek of the suppression of the gold price and tell you the game will have an end date. I think we might be very close to that end date now. I know lots of your readers and listeners will have seen a comment by some reporter from Bloomberg who suggested that the Bank of England's vaults were empty now. [LAUGHTER.]

And I suspect that is very close to the truth -- that the supply is dwindling, and someday they just give up on it. Like they should be giving up on the policy of money printing. They accomplished nothing. We’re so misguided on all this stuff. It’s not working. All we’re doing is piling on the debt. Well, there is a cost to debt and that cost gets bigger all the time.

A lot of the policy to keep the gold price suppressed is not going to work. How could anybody honestly believe that inflation is only 2 percent? It’s so ridiculous, and even the public is now realizing it’s ridiculous. The central planners have played a game that hasn’t worked, and there will be a price to pay.

When you see a bank goes down, what’s the first thing you think about? ‘I want my money out of the bank. Where am I going to put it all? I better put it into something real.’ We keep hearing that the bad loan problems are getting worse, the trading volumes for the commercial banks are going down, the spreads are narrowing. And I would never have my money in a bank. They are so levered and risky.

It’s funny that it doesn’t strike people as being risky, but when you put your deposit into a bank, you’ve lent your money to the bank. If the money is lent to someone else who is not going to repay it, you are going to be on the hook for it. We just had the German government approve of bail-ins in that country. So we are all set up for it. Everybody knows there is going to be a problem in the banking industry because it’s just way too levered based on any normalcy in banking. So our day will come.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/15_Billionaire_Sprott_-_The_Bank_Of_England_Gold_Vaults_Are_Empty.html

Now Germany Will Never Get Its Gold Back From The U.S. Fed

"Today an acclaimed money manager stunned King World News when he said that Germany will never get its gold back from the U.S. Fed, and the reason will surprise KWN readers around the world. Stephen Leeb went on to elaborate about what is happening behind the scenes that has caused this rift between the U.S. and Germany.

Leeb: “Right now I am focused on the major economies of the world. Russian President Vladimir Putin, Chinese President Xi, and German Chancellor Angela Merkel were all together at the World Cup in Brazil. No matter where you look these three countries are being brought together....

Leeb: “Right now I am focused on the major economies of the world. Russian President Vladimir Putin, Chinese President Xi, and German Chancellor Angela Merkel were all together at the World Cup in Brazil. No matter where you look these three countries are being brought together....

“And today John Kerry turned to China to help with the Iranian negotiations. Good luck. China may or may not help, but they will do what is in the interest of China, Russia, and Germany. That’s the name of the game.

None of them care what the United States wants. Meanwhile there is still fighting going on in the Ukraine. So the United States is slowly losing power, losing hegemony. There was clearly a time when the United States, because of the strength of its dollar, because of the strength of its military, was clearly the dominant power in the world. That’s not true anymore. Yet the U.S. is still acting like it’s the only game in town.

Right now Russia is challenging the United States in Iraq. They have been sending in planes and other weapons to support the military. Iran is also working with Russia to aid Iraq. The question then becomes: How long can the United States keep its reserve currency status as it continues to lose power?

As the U.S. continues to lose its influence and reserve currency status, this will send even more money into gold and silver. Well, China’s photovoltaics program will require 25 percent to 30 percent of the world’s silver by the end of the decade. Guess what: We don’t have it. The world doesn’t have that much additional silver.

Something will have to give, and it will be the price of silver. That’s just one of the many reasons why silver will be trading well over $100. That’s why these dips like we have seen over the past couple of days are not going to be as severe as before. The other problem the manipulators have is there is now a bid in the gold market, and I mean a real bid.

China just reported that they now have $3.99 trillion in reserves. This is why it’s funny when you keep reading articles from Bloomberg about how much debt the Chinese have and how much money they are spending. Well, they have $4 trillion in foreign exchange reserves to play with. This is why the Chinese will continue to accumulate record amounts of physical gold.

The Chinese don’t want to see their reserves lose value, and that’s why they are buying incredibly large quantities of physical gold. That’s why I’m saying there is a solid bid under this gold market. I don’t know if the bid is just below $1,300, $1,280 or $1,250, but there is something different going on with the bidding.

So the next step for gold is to break out of its base and head to new all-time highs. Then it’s really going to be off to the races. Silver will take care of itself. You can bet on it as a precious or industrial metal. So investors are going to make a lot of money in silver.

But gold, that’s the one that you really have to watch because that is the barometer that tells you how much the U.S. is losing its power in the world. And if I’m right about this bid in the gold market, this decline will be short-lived and it will head to new highs very quickly.

And as far as China goes, we have no idea how much gold they have accumulated. Nobody knows how much gold they are buying -- not the World Gold Council or anyone else. The gold is now flowing into China from all directions and they don’t want the West to know how much they are accumulating.

As soon as China, Russia, and Germany have enough gold, they are going to form a new currency bloc. It will be comprised of yuan, marks, rubles, and gold. This is why the Fed won’t give Germany any of its gold back. The U.S. has picked up on this and so the Fed is denying Germany its gold.

The Fed promised to send Germany a mere 300 tons of its 1,436 tons of gold the Fed is supposed to have stored. Well, only 5 tons have made their way back to Germany because the Fed knows what Germany is up to with the Chinese and the Russians, and so there is no way in hell the Fed is going to give Germany back its gold at this point. Germany, you may have won the World Cup but you will have to go into the open market if you want your gold back.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/16_Now_Germany_Will_Never_Get_Its_Gold_Back_From_The_U.S._Fed.html

A Full-Blown Crisis Is Coming & There Will Be Hell To Pay

"Today one of the wealthiest people in the financial world warned King World News that a full-blown crisis is coming and there will be hell to pay. Rick Rule, who is business partners with Eric Sprott, also discussed the trouble in the banking system in Europe and the German move to approve bail-ins.

Eric King: “Rick, we are seeing the reemergence of the banking crisis. Germany has just moved to legalize bail-ins. Obviously this is going to get out of hand once again. How bad is this going to get?”

Rule: “We have warned about this for some time on King World News. I think what we said last year was that none of the principle causes of the global financial crisis in 2008 were ever addressed....

“The only thing that happened was the central banks around the world added liquidity to the system. The central banks would like investors and voters to believe that liquidity, that is short term cash, is a substitute for solvency. It’s not.

If a person has $10,000 but they owe $1,000,000 to the bank, they might not have a problem this month, but they certainly will as time goes on, and time has gone on. So, as an example, we see a problem with the bank in Portugal that had some mispriced assets. Isn’t that a surprise? (Laughter).

The truth, Eric, is that the big thinkers of the world have pretty much guaranteed there are going to be mispriced assets on banks’ balance sheets as a consequence of Basel III. Your readers will remember that Basel III was that highly intelligent piece, I’m being facetious, piece of legislation that allows banks to carry loans to governments on their books as unimpaired by market if they ‘Plan to hold them to maturity.’

So if a Portuguese bank had bought bonds which were selling at 70 percent of par, the bank would be allowed to hold them on their books at 100 percent of par. They are allowed to mark those assets to ‘myth,’ as opposed to marking them to market. This guarantees that all of the euro center banks have followed a business plan where they borrow short term from the euro window, and they lend longer term to semi-insolvent sovereign borrowers on the European periphery. This is a slow-motion road to bankruptcy.

I see the German move to approve bail-ins as a situation where the banks are beginning to give themselves the tools to dig themselves out of the box that they’ve gotten themselves in. Europe needs to look to Japan, where Japan had a lost decade that turned into a lost 16 years. The problem for Europe is there are increasing amounts of dislocation in the European community.

As an example, German citizens rightly feel like they are carrying the rest of Europe. So there are divisions in Europe over this strategy that were not apparent in Japan because Japan is a very homogenous society. I can’t say a full-blown crisis is going to rear its head tomorrow or next week, but a crisis is coming and there will be hell to pay at some point.”

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/16_A_Full-Blown_Crisis_Is_Coming_%26_There_Will_Be_Hell_To_Pay.html

Tuesday, July 15, 2014

Portugal Contagion Spreads: Espirito Santo To Default On Portugal Telecom Loan, Business Lending Drops Most On Record

"Despite reassurances from US asset-gatherers and TV 'personalities' that Portugal must be fixed (because US equities are up), it is anything but. Today's triple whammy from the 'recovered' Portugal starts withBanco Espirito Santo bonds and stocks hitting new record lows (down over 10% more on the day). The contagion has rippled across to Rioforte, which controls Grupo Espirito Santo's non-financial arm - and islikely to default on a EUR 847 million payment to Portugal Telecom. And just to add further salt to that wound, Portuguese business lending in May collapsed at a record pace (down 8.23%). But apart from that, yeash Portugal is all fixed and their sovereign bonds are worth every penny...

Step 1 - Banco Espirito Santo bonds and stocks continue to collapse..."

at http://www.zerohedge.com/news/2014-07-15/portugal-contagion-spreads-espirito-santo-default-portugal-telecom-loan-business-len

Gold Plunges Back Below $1300 As "Someone" Dumps $2.3 Billion In Futures

"With The Fed proclaiming bubbles in some of the most-loved segments of the stock market and explaining that the economy is doing "ok" but they must remain dovish for longer for feasr of "false dawns"... what better time than now to dump $2.3 Billion notional in futures... of course the dump in gold's anti-status quo price coincided with an odd v-shaped recovery in stocks... Gold remains above its pre-June FOMC levels still.

The break was precipitated by the sale of over 17,000 contracts (or over $2.3 Billion notional)..."

at http://www.zerohedge.com/news/2014-07-15/gold-plunges-back-below-1300-someone-dumps-15-billion-futures

Why The Status-Quo Is Unsustainable: Interest and Debt (What Yellen Won't Tell You)

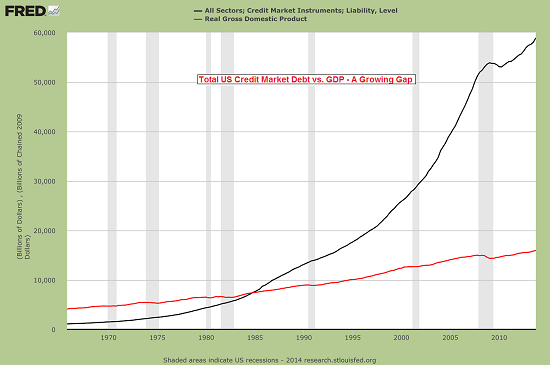

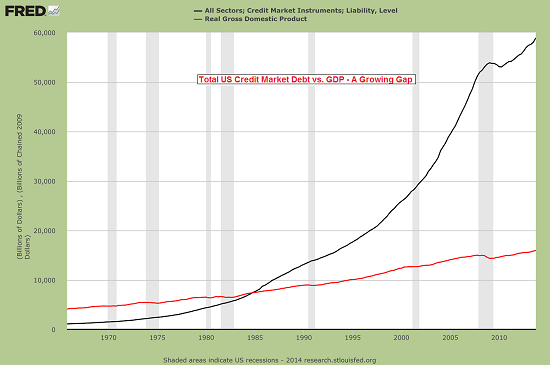

"Even if the economy were growing at a faster pace, it wouldn't come close to offsetting the interest payments on our ever-expanding debt.

If you want to know why the Status Quo is unsustainable, just look at interest and debt. These are not difficult to understand: debt is a loan that must be paid back or discharged/written off and the loss absorbed by the lender. Interest is paid on the debt to compensate the owner of the money for the risk of loaning it to a borrower.

It's easy to see what's happening with debt and the real economy (as measured by GDP, gross domestic product): debt is skyrocketing while real growth is stagnant. Put another way--we have to create a ton of debt to get a pound of growth.

There is no other way to interpret this chart.

at http://www.zerohedge.com/news/2014-07-15/why-status-quo-unsustainable-interest-and-debt-what-yellen-wont-tell-you

China Warns US To Stay Out Of South China Sea Dispute

"A week ago, China made it very clear to the US that while it is happy to preserve cordial relations and smile on photo ops, it had no problems with taking the US to task, and even the battlefield, financial or conventional, should the US - having lost most of its credibility in recent years - dare to interfere. It said it so clearly only an idiot could have misread it: "A conflict between China and United States will definitely be a disaster for the two countries and the world,” Xi said. “As long as we uphold mutual respect, maintain strategic patience and remain unperturbed by individual incidents and comments, we’ll be able to keep relations on a firm footing despite ups and downs that may come our way.”

at http://www.zerohedge.com/news/2014-07-15/china-warns-us-stay-out-south-china-sea-dispute

at http://www.zerohedge.com/news/2014-07-15/china-warns-us-stay-out-south-china-sea-dispute

Jim Rogers: Only a Russian/Chinese/Brazil joint-currency can battle dollar dominance - See more at: http://ausbullion.blogspot.com.tr/2014/07/jim-rogers-only-russianchinesebrazil.html#sthash.ZRIxijqt.dpuf

at http://ausbullion.blogspot.com.tr/2014/07/jim-rogers-only-russianchinesebrazil.html

ames Turk - Bank Shorts Orchestrating Gold & Silver Smash

"With continued turmoil in major markets, today James Turk told King World News that bullion bank shorts orchestrated today’s smash in the gold and silver markets. Turk also gave some fascinating statistics regarding today’s takedown in the metals and discussed what investors should expect next..."

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/14_James_Turk_-_Bank_Shorts_Orchestrating_Gold_%26_Silver_Smash.html

at http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/7/14_James_Turk_-_Bank_Shorts_Orchestrating_Gold_%26_Silver_Smash.html

Steve Forbes Promotes a Gold Standard

"Steve Forbes, speaking recently in Las Vegas, continued to advocate a gold standard of sorts– i.e. pegging the US dollar to gold at (say) $1200 per ounce. If gold rises to $1300, the Fed decreases the supply of dollars. It it falls to $1100, the Fed inflates..."

at http://bastiat.mises.org/2014/07/steve-forbes-promotes-a-gold-standard/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MisesBlog+%28Mises+Economics+Blog%29

at http://bastiat.mises.org/2014/07/steve-forbes-promotes-a-gold-standard/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MisesBlog+%28Mises+Economics+Blog%29

Subscribe to:

Posts (Atom)